#Gold #FTSE Market movements on Friday was indicative of the converse for TDS, a brand new illness invented in America called Trump Derangement Syndrome. We’ve been expecting a market surge once Mr Trump adorns the symbols of office, a MAGA hat, a McDonalds Burger and an AR15 type of rifle. We’d to smile a bit at the news of an attempt to mimic Make America Great Again (MAGA) with a similar European movement, inevitably bearing the moniker (MEGA), reminiscent of a time which never was. Bits of Europe were brilliant but generally before the creeping damage from the EU.

It’s easy to suspect many people look back fondly on the days of Germany before the EU, France feeling utterly free and chaotic, Spain being proud of itself, Austria refusing to let go of tradition, and the UK hospitality industry unable to spell ‘welcome’.. Nowadays, Europe feels about as authentic as a visit to Ikea, a drab land of homogenised versions of what’s wanted, a bland example of The Jam’s lyric; ‘the public wants what the public gets‘ from their classic angry track “Going Underground”.

Friday witnessed the FTSE surge upward, just like a queue of airline travellers when a delayed departure gate to escape the UK opens. The index certainly exceeded our near term targets on Friday, even managing to close 9 points above our secondary and more importantly, substantially exceeding it during the session. This gives considerable hope for the days to come and it’d be foolish to ignore some very visible potentials for the retail banking sector.

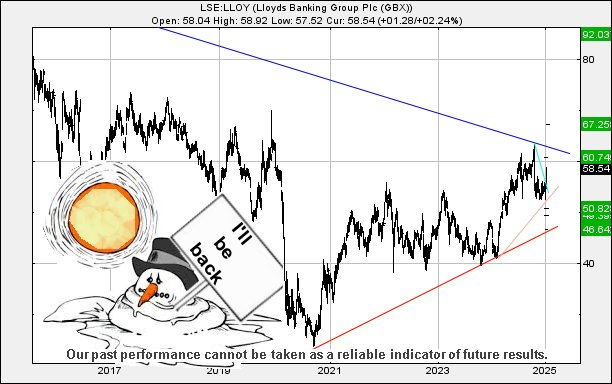

Lloyds managed to close Friday at a near term higher high, achieving a point higher than any since October of last year. As a result, there are a couple of strange looking potentials immediately available as movement on Lloyds above 59p now points at an almost confident visit to 60.7p. At this point, we run into a problem unless the market starts to gap Lloyds share price up at the open as it’s difficult to pull a closing price target above 60.7p from anywhere. In theory, share price movement above 60.7p should allow continued growth to 67.2p but, to be fair, we don’t trust the calculation as it’s got a track record of being wrong. But importantly, in the even this share price manages to somehow close a session above Blue at 63p, it enters a cycle where a long term 92p makes a lot, an awful lot, of sense.

FUTURES

FUTURES

| Time Issued | Market | Price At Issue | Short Entry | Fast Exit | Slow Exit | Stop | Long Entry | Fast Exit | Slow Exit | Stop |

| 1:50:50AM | BRENT | 8020.4 | ||||||||

| 1:56:12AM | GOLD | 2701.53 | 2700 | 2693 | 2682 | 2712 | 2719 | 2726 | 2735 | 2703 |

| 2:02:26AM | FTSE | 8501.8 | 8410 | 8363 | 8306 | 8483 | 8525 | 8540 | 8720 | 8495 |

| 2:06:28AM | STOX50 | 5144.5 | ||||||||

| 2:11:38AM | GERMANY | 20891 | ||||||||

| 2:42:05AM | US500 | 5997 | ||||||||

| 2:46:51AM | DOW | 43470 | ||||||||

| 2:49:22AM | NASDAQ | 21435 | ||||||||

| 2:53:49AM | JAPAN | 38796 |

17/01/2025 FTSE Closed at 8505 points. Change of 1.36%. Total value traded through LSE was: £ 7,049,507,611 a change of 39.47%

16/01/2025 FTSE Closed at 8391 points. Change of 1.08%. Total value traded through LSE was: £ 5,054,366,255 a change of -17.27%

15/01/2025 FTSE Closed at 8301 points. Change of 1.22%. Total value traded through LSE was: £ 6,109,137,300 a change of -9.61%

14/01/2025 FTSE Closed at 8201 points. Change of -0.28%. Total value traded through LSE was: £ 6,758,270,581 a change of 5.88%

13/01/2025 FTSE Closed at 8224 points. Change of -0.3%. Total value traded through LSE was: £ 6,383,033,146 a change of 23.46%

10/01/2025 FTSE Closed at 8249 points. Change of -0.84%. Total value traded through LSE was: £ 5,170,108,064 a change of -6.19%

9/01/2025 FTSE Closed at 8319 points. Change of 11.63%. Total value traded through LSE was: £ 5,511,068,613 a change of -13.81%

SUCCESS above means both FAST & SLOW targets were met. ‘CESS means just the FAST target met and probably the next time it is exceeded, movement to the SLOW target shall commence.

Our commentary is in two sections. Immediately below are today’s updated comments. If our commentary remains valid, the share can be found in the bottom section which has a RED heading. Hopefully, this will mean you no longer need to flip back through previous reports. HYPERLINKS DISABLED IN THIS VERSION

Please remember, all prices are mid-price (halfway between the Buy and Sell). When we refer to a price CLOSING above a specific level, we are viewing the point where we can regard a trend as changing. Otherwise, we are simply speculating on near term trading targets. Our website is www.trendsandtargets.com.

UPDATE. We often give an initial and a secondary price. If the initial is exceeded, we still expect it to fall back but the next time the initial is bettered, the price should continue to the secondary. The converse it true with price drops.

We can be contacted at info@trendsandtargets.com. Spam filters set to maximum so only legit emails get through…

Section One – Outlook Updated Today. Click here for Section Two – Outlook Remains Valid shares

Click Epic to jump to share: LSE:AV. Aviva** **LSE:BARC Barclays** **LSE:GKP Gulf Keystone** **LSE:HIK Hikma** **LSE:HSBA HSBC** **LSE:IGG IG Group** **LSE:IHG Intercontinental Hotels Group** **LSE:RKH Rockhopper** **LSE:SMT Scottish Mortgage Investment Trust** **LSE:STAN Standard Chartered** **

********

Updated charts published on : Aviva, Barclays, Gulf Keystone, Hikma, HSBC, IG Group, Intercontinental Hotels Group, Rockhopper, Scottish Mortgage Investment Trust, Standard Chartered,

LSE:AV. Aviva. Close Mid-Price: 495.5 Percentage Change: + 0.77% Day High: 497.6 Day Low: 492.8

In the event of Aviva enjoying further trades beyond 497.6, the share sho ……..

</p

View Previous Aviva & Big Picture ***

LSE:BARC Barclays. Close Mid-Price: 289.35 Percentage Change: + 2.35% Day High: 291.75 Day Low: 284.8

Target met. All Barclays needs are mid-price trades ABOVE 291.75 to impro ……..

</p

View Previous Barclays & Big Picture ***

LSE:GKP Gulf Keystone Close Mid-Price: 166.4 Percentage Change: -2.46% Day High: 172.1 Day Low: 166.2

Target met. All Gulf Keystone needs are mid-price trades ABOVE 172.1 to i ……..

</p

View Previous Gulf Keystone & Big Picture ***

LSE:HIK Hikma. Close Mid-Price: 2086 Percentage Change: + 0.68% Day High: 2102 Day Low: 2080

Target met. Further movement against Hikma ABOVE 2102 should improve acce ……..

</p

View Previous Hikma & Big Picture ***

LSE:HSBA HSBC. Close Mid-Price: 822.7 Percentage Change: + 0.60% Day High: 828.2 Day Low: 818.5

Further movement against HSBC ABOVE 828.2 should improve acceleration tow ……..

</p

View Previous HSBC & Big Picture ***

LSE:IGG IG Group. Close Mid-Price: 1054 Percentage Change: + 0.76% Day High: 1056 Day Low: 1043

All IG Group needs are mid-price trades ABOVE 1056 to improve acceleratio ……..

</p

View Previous IG Group & Big Picture ***

LSE:IHG Intercontinental Hotels Group. Close Mid-Price: 10365 Percentage Change: + 1.32% Day High: 10415 Day Low: 10210

Target met. All Intercontinental Hotels Group needs are mid-price trades ……..

</p

View Previous Intercontinental Hotels Group & Big Picture ***

LSE:RKH Rockhopper. Close Mid-Price: 39.6 Percentage Change: + 3.66% Day High: 40.3 Day Low: 38.3

Target met. All Rockhopper needs are mid-price trades ABOVE 40.3 to impro ……..

</p

View Previous Rockhopper & Big Picture ***

LSE:SMT Scottish Mortgage Investment Trust. Close Mid-Price: 1046 Percentage Change: + 2.45% Day High: 1044.5 Day Low: 1019.5

In the event of Scottish Mortgage Investment Trust enjoying further trade ……..

</p

View Previous Scottish Mortgage Investment Trust & Big Picture ***

LSE:STAN Standard Chartered. Close Mid-Price: 1076.5 Percentage Change: + 0.89% Day High: 1081 Day Low: 1067.5

Continued trades against STAN with a mid-price ABOVE 1081 should improve ……..

</p

View Previous Standard Chartered & Big Picture ***