#Brent #Dax Every now and then, we all make a colossal mistake. Invariably, our most recent involves our little red tractor and the cutting deck. During winter, an idea burst into fruition. I could creating a slot in the side of the cutting deck to allow cut grass to fountain out. It seemed a reasonable idea but the reality has been a mess, a lawn eventually covered with hay rather than the usual clumps of grass waiting for a dog to squirm on. It was all very strange as we’ve two blades, measuring 38 inches, which are supposed to mulch the grass creating a healthy lawn.

Of course, laziness was the reason as there are few things more irritating than two passes of the grass, then stopping to reverse and tip the grass collector. We’d changed to “mulching blades” a couple of years ago and cheerfully ditched the absurd hydraulic collection box. This year has been the first time trying the mulching blades alongside with my new invention of a grass exhaust port on the deck. It transpires, this was stupid, a very real “Read The Friggin Manual” moment due to my winter servicing with a cutting torch making mulched grass an impossibility. So now, this weekend, I’ve been cutting steel plate to weld over my invented cutting deck exhaust, undoing my error and once again forcing the machine to create healthy mulch for the lawn. The annoying thing is being able to write about this in a single paragraph, despite the hours already involved in some heavy and hard work. It was tempting to use our 3d Printer to knock together a cover for the new hole but reality shall ensure it will somehow get sucked into the metre wide blades and eaten.

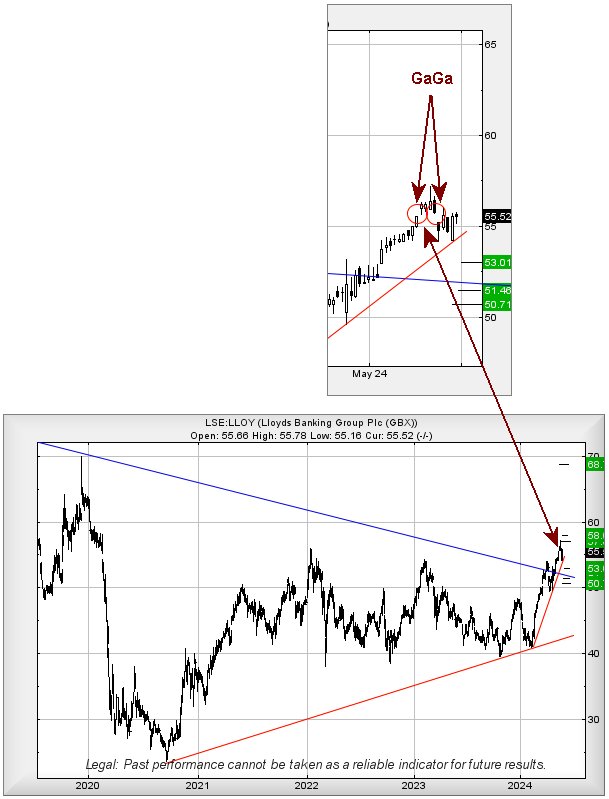

Rather neatly, this brings us to one of the mothers and fathers of colossal mistakes, the UK retail bank known as Lloyds, famous purveyors of horse meat from a black horse… Something quite interesting appears to be going on, perhaps finally justifying our three weekly review of the ongoing mess. Goodness knows, over the years, we’re written a huge amount of fertilizer about Lloyds as it carefully has avoided doing anything useful.

Last time we reviewed Lloyds, we’d given 55.8p as a fairly major target and it’s been ambition easily achieved. Now, there’s a visual risk of things going a little wrong as the share price has suffered a GaGa, a Gap Up followed by a Gap Down. This particular market dance step, almost unique to the UK market, calculates with an interesting possibility, one which suggests an attempt may be underway to “slow” down the pace of Lloyds movements for reasons we don’t get. But the immediate situation is one of mild catastrophe with movement below 54.4p potentially triggering reversals to 53p with our secondary, if broken, at 51.4p. Unfortunately, thanks to the width of the gapping movements, these numbers, especially the secondary, enjoy a 0.7p error potential.

Over the years, we’ve had plenty of time to map these GaGa events and they’re usually quite reliable. In this instance, should it trigger, we’d actually hope for a bounce above our 51.4 secondary as the market appears to be anointing that blue line with a degree of importance. And of course, should the market opt to Gap Lloyds upward at the open anytime soon, all bets are off as guesswork will be needed to map any fall.

In the less likely event the market continues some sort of upward push against Lloyds, above just 56p should now make an effort to attain 57p next and visually, some possible hesitation. Our secondary, if bettered, calculates at a suspiciously precise 58p but, in the event the share price closes above 57p, it enters the realms of a longer term cycle to an impressive 68p.

FUTURES

| Time Issued | Market | Price At Issue | Short Entry | Fast Exit | Slow Exit | Stop | Long Entry | Fast Exit | Slow Exit | Stop |

| 11:07:12PM | BRENT | 8076.7 | 8044 | 7708 | 7218 | 8362 | 8159 | 8185 | 8228 | 8099 |

| 11:11:03PM | GOLD | 2327 | 2340 | |||||||

| 11:14:25PM | FTSE | 8297 | 8258 | |||||||

| 11:16:54PM | STOX50 | 5004.5 | 4984 | |||||||

| 11:18:59PM | GERMANY | 18586 | 18424 | 18388 | 18317 | 18493 | 18601 | 18693 | 18796 | 18500 |

| 11:21:53PM | US500 | 5285 | 5262 | |||||||

| 11:27:52PM | DOW | 38733 | 38507 | |||||||

| 11:30:12PM | NASDAQ | 18529 | 18491 | |||||||

| 11:32:02PM | JAPAN | 38755 | 38663 |

31/05/2024 FTSE Closed at 8275 points. Change of 0.53%. Total value traded through LSE was: £ 14,399,322,984 a change of 74.95%

30/05/2024 FTSE Closed at 8231 points. Change of 0.59%. Total value traded through LSE was: £ 8,230,680,116 a change of 35.4%

29/05/2024 FTSE Closed at 8183 points. Change of -0.86%. Total value traded through LSE was: £ 6,078,579,262 a change of 7.75%

28/05/2024 FTSE Closed at 8254 points. Change of -0.76%. Total value traded through LSE was: £ 5,641,394,856 a change of 14.03%

24/05/2024 FTSE Closed at 8317 points. Change of -0.26%. Total value traded through LSE was: £ 4,947,346,285 a change of -38.57%

23/05/2024 FTSE Closed at 8339 points. Change of -0.37%. Total value traded through LSE was: £ 8,053,731,391 a change of 27.95%

22/05/2024 FTSE Closed at 8370 points. Change of -0.55%. Total value traded through LSE was: £ 6,294,493,963 a change of 14.87%

SUCCESS above means both FAST & SLOW targets were met. ‘CESS means just the FAST target met and probably the next time it is exceeded, movement to the SLOW target shall commence.

Our commentary is in two sections. Immediately below are today’s updated comments. If our commentary remains valid, the share can be found in the bottom section which has a RED heading. Hopefully, this will mean you no longer need to flip back through previous reports. HYPERLINKS DISABLED IN THIS VERSION

Please remember, all prices are mid-price (halfway between the Buy and Sell). When we refer to a price CLOSING above a specific level, we are viewing the point where we can regard a trend as changing. Otherwise, we are simply speculating on near term trading targets. Our website is www.trendsandtargets.com.

UPDATE. We often give an initial and a secondary price. If the initial is exceeded, we still expect it to fall back but the next time the initial is bettered, the price should continue to the secondary. The converse it true with price drops.

We can be contacted at info@trendsandtargets.com. Spam filters set to maximum so only legit emails get through…

Section One – Outlook Updated Today. Click here for Section Two – Outlook Remains Valid shares

Click Epic to jump to share: LSE:AFC AFC Energy** **LSE:GKP Gulf Keystone** **LSE:GRG Greggs** **LSE:IGG IG Group** **LSE:ITV ITV** **LSE:RKH Rockhopper** **LSE:TLW Tullow** **

********

Updated charts published on : AFC Energy, Gulf Keystone, Greggs, IG Group, ITV, Rockhopper, Tullow,

LSE:AFC AFC Energy Close Mid-Price: 23.2 Percentage Change: -3.93% Day High: 26 Day Low: 24.05

Target met. In the event of AFC Energy enjoying further trades beyond 26, ……..

</p

View Previous AFC Energy & Big Picture ***

LSE:GKP Gulf Keystone. Close Mid-Price: 143.3 Percentage Change: + 1.42% Day High: 145 Day Low: 140.9

Further movement against Gulf Keystone ABOVE 145 should improve accelerat ……..

</p

View Previous Gulf Keystone & Big Picture ***

LSE:GRG Greggs. Close Mid-Price: 2940 Percentage Change: + 0.00% Day High: 2946 Day Low: 2920

Further movement against Greggs ABOVE 2946 should improve acceleration to ……..

</p

View Previous Greggs & Big Picture ***

LSE:IGG IG Group. Close Mid-Price: 810 Percentage Change: + 2.47% Day High: 810.5 Day Low: 785

Target met. In the event of IG Group enjoying further trades beyond 810.5 ……..

</p

View Previous IG Group & Big Picture ***

LSE:ITV ITV. Close Mid-Price: 79.6 Percentage Change: + 2.05% Day High: 79.8 Day Low: 77.85

All ITV needs are mid-price trades ABOVE 79.8 to improve acceleration tow ……..

</p

View Previous ITV & Big Picture ***

LSE:RKH Rockhopper. Close Mid-Price: 14.2 Percentage Change: + 0.71% Day High: 14.15 Day Low: 13.5

All Rockhopper needs are mid-price trades ABOVE 14.15 to improve accelera ……..

</p

View Previous Rockhopper & Big Picture ***

LSE:TLW Tullow Close Mid-Price: 39.14 Percentage Change: -0.86% Day High: 40.32 Day Low: 38.28

In the event of Tullow enjoying further trades beyond 40.32, the share sh ……..

</p

View Previous Tullow & Big Picture ***