#Gold #DOW

As far as we’re aware, the only thing these two shares have in common is something to do with oil, along with both featuring in our emails. Pantheon actually present a bit of an issue for us, we covered the share in February and movements since have proven problematic. Aka, weakness for some reason!

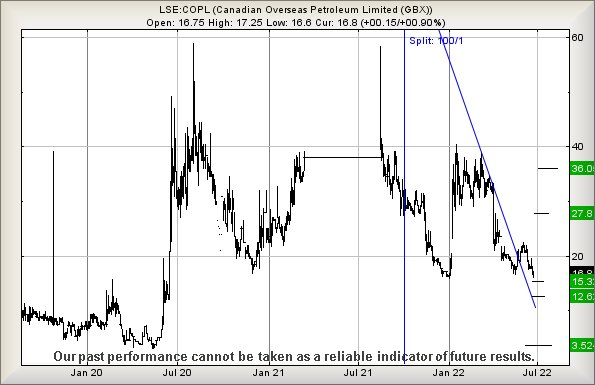

Canadian Overseas Petroleum Ltd (referred to as COPL), based in Canada and listed on both the LSE and Canadian market, are headquartered in Canada, operating in North America and Africa. In October 2021, the company indulged in our least favourite method to make their share price sound attractive, a 100:1 split. This, “we’ll take 100 of your 0.3p shares and give you a brand new 30p share back” rarely ends well for private investors, often feeling like a last ditch effort to delay an inevitable crash or delisting. Currently trading around 17p, it’s unlikely many folk are impressed with price movements since the share split.

Making matters worse, there’s an immediate threat of weakness below 16.15p triggering near term reversals down to an initial 15.3p with our secondary calculation, if this initial target breaks, working out at 12.6p and hopefully a proper bounce. Visually there’s very little encouraging a bounce at such a level, other than the slightly vague Blue downtrend since 2016 and a hope a bunch of folk dig out their coloured crayons, assuming this trend line shall prove important.

Hopefully this indeed proves the case as such a level of reversal risks horrific long term consequences, taking the share price into a zone where an “ultimate” bottom works out at 3.5p, this being a level below which we cannot calculate.

COPL requires to exceed 22.5p to suggest an attempt to escape its immediate doom is kicking into play.

Pantheon Resources Plc are proving just a little confusing at present. Earlier this year, the share price produced all our required criteria to shift upward to 166p, the rise completely fading out at 156p and falling remorselessly since. We’re just a little curious as to whether the reversals are about to cease as there’s currently no doubt the share price is reacting to Blue on the chart below. The problem is, the share needs start trading above 103p to convince us a rebound is probably genuine!

Thankfully, there are early indications which point toward optimism as above 103p currently calculates with the potential of recovery to an initial 118p. If bettered, our secondary works out at 141p and an almost certain requirement to visit the numbers yet again.

If everything intends go pear shaped, Pantheon needs reverse below 86p to press the panic button, allowing downward movement to an initial 64p with secondary, if broken, a hopeful bottom level at 47p.

FUTURES

| Time Issued | Market | Price At Issue | Short Entry | Fast Exit | Slow Exit | Stop | Long Entry | Fast Exit | Slow Exit | Stop | Prior |

| 9:44:43PM | BRENT | 111.5 | ‘cess | ||||||||

| 9:46:47PM | GOLD | 1823.58 | 1820 | 1814 | 1805 | 1828 | 1833 | 1835 | 1840 | 1827 | |

| 9:48:28PM | FTSE | 7258.95 | ‘cess | ||||||||

| 9:50:49PM | FRANCE | 6029.8 | ‘cess | ||||||||

| 9:53:10PM | GERMANY | 13163.2 | ‘cess | ||||||||

| 10:01:06PM | US500 | 3906.37 | ‘cess | ||||||||

| 10:03:17PM | DOW | 31480 | 31289 | 31154 | 30966 | 31515 | 31718 | 31768 | 32482 | 31538 | ‘cess |

| 10:05:02PM | NASDAQ | 12039.59 | |||||||||

| 10:08:05PM | JAPAN | 26739 |

27/06/2022 FTSE Closed at 7258 points. Change of 0.69%. Total value traded through LSE was: £ 6,347,029,355 a change of 0.8%

24/06/2022 FTSE Closed at 7208 points. Change of 2.68%. Total value traded through LSE was: £ 6,296,850,381 a change of 10.86%

23/06/2022 FTSE Closed at 7020 points. Change of -0.97%. Total value traded through LSE was: £ 5,680,077,638 a change of -12.72%

22/06/2022 FTSE Closed at 7089 points. Change of -0.88%. Total value traded through LSE was: £ 6,507,643,698 a change of 40.38%

21/06/2022 FTSE Closed at 7152 points. Change of 0.44%. Total value traded through LSE was: £ 4,635,756,984 a change of -23.37%

20/06/2022 FTSE Closed at 7121 points. Change of 1.5%. Total value traded through LSE was: £ 6,049,529,686 a change of -50.99%

17/06/2022 FTSE Closed at 7016 points. Change of -0.4%. Total value traded through LSE was: £ 12,344,389,846 a change of 36.38%

SUCCESS above means both FAST & SLOW targets were met. ‘CESS means just the FAST target met and probably the next time it is exceeded, movement to the SLOW target shall commence.

Our commentary is in two sections. Immediately below are today’s updated comments. If our commentary remains valid, the share can be found in the bottom section which has a RED heading. Hopefully, this will mean you no longer need to flip back through previous reports. HYPERLINKS DISABLED IN THIS VERSION

Please remember, all prices are mid-price (halfway between the Buy and Sell). When we refer to a price CLOSING above a specific level, we are viewing the point where we can regard a trend as changing. Otherwise, we are simply speculating on near term trading targets. Our website is www.trendsandtargets.com.

UPDATE. We often give an initial and a secondary price. If the initial is exceeded, we still expect it to fall back but the next time the initial is bettered, the price should continue to the secondary. The converse it true with price drops.

We can be contacted at info@trendsandtargets.com. Spam filters set to maximum so only legit emails get through…

Section One – Outlook Updated Today. Click here for Section Two – Outlook Remains Valid shares

Click Epic to jump to share: LSE:ASC Asos** **LSE:AZN Astrazeneca** **LSE:CBX Cellular Goods** **LSE:IPF International Personal Finance** **LSE:RBD Reabold Resources PLC** **LSE:RKH Rockhopper** **

********

Updated charts published on : Asos, Astrazeneca, Cellular Goods, International Personal Finance, Reabold Resources PLC, Rockhopper,

LSE:ASC Asos Close Mid-Price: 876.5 Percentage Change: -1.35% Day High: 922.5 Day Low: 870

Above 923 looks capable of a lift to 992 with secondary, if bettered, at 1 ……..

</p

View Previous Asos & Big Picture ***

LSE:AZN Astrazeneca. Close Mid-Price: 10806 Percentage Change: + 0.28% Day High: 10850 Day Low: 10652

Further movement against Astrazeneca ABOVE 10850 should improve accelerati ……..

</p

View Previous Astrazeneca & Big Picture ***

LSE:CBX Cellular Goods Close Mid-Price: 1.2 Percentage Change: -2.04% Day High: 1.27 Day Low: 1.12

In the event Cellular Goods experiences weakness below 1.12 it calculates ……..

</p

View Previous Cellular Goods & Big Picture ***

LSE:IPF International Personal Finance Close Mid-Price: 75 Percentage Change: -4.34% Day High: 79.3 Day Low: 75

Continued weakness against IPF taking the price below 75 calculates as le ……..

</p

View Previous International Personal Finance & Big Picture ***

LSE:RBD Reabold Resources PLC Close Mid-Price: 0.26 Percentage Change: -7.02% Day High: 0.29 Day Low: 0.26

In the event Reabold Resources PLC experiences weakness below 0.26 it cal ……..

</p

View Previous Reabold Resources PLC & Big Picture ***

LSE:RKH Rockhopper. Close Mid-Price: 7.17 Percentage Change: + 1.27% Day High: 7.1 Day Low: 6.62

If Rockhopper experiences continued weakness below 6.62, it will invariab ……..

</p

View Previous Rockhopper & Big Picture ***