#FTSE #NK225 With surprising regularity, ‘Conspiracy Theories’ seem to turn into ‘so called Conspiracy Theories’ on their eventual path to being taken seriously. The current emergence of UFO silliness has morphed into the world of acceptable, just by changing the acronym. UFO’s, in becoming ‘UAP’s, are now deemed acceptable topics, even on the nightly news. The DAX opens itself up to a whole nest of conspiracy issues, thanks to a couple of circled gaps on the chart below.

Folk sometimes think “The Market is out to get me!” and at times, it feels like it’s out to get us too.

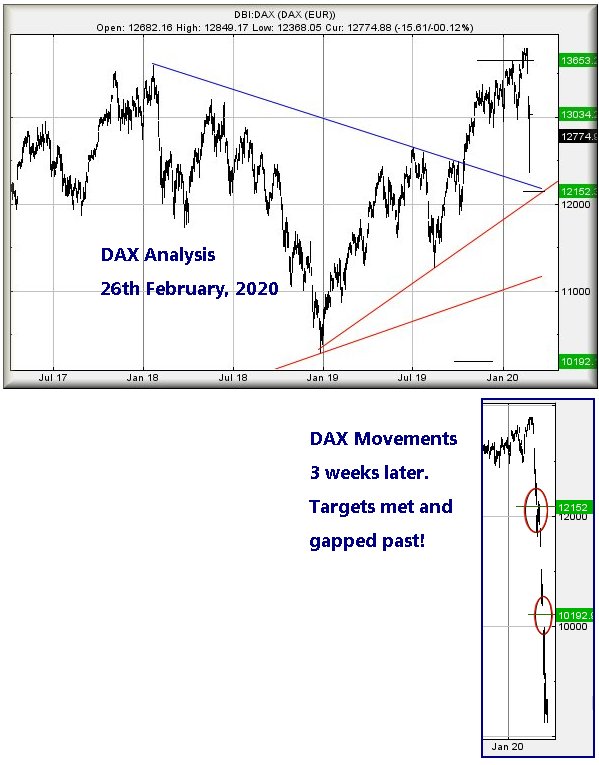

The chart below is interesting. We obviously remain bemused when encountering market manipulation gaps but this series from Germany left us wide eyed. Our analysis on the DAX from 26th February introduced some pretty large drop targets. The first one suggested the potential of a 600 point reduction to 12,152 points. Our target was achieved, just 4 sessions later but the method by which the success appeared was strange. The index was gapped down, breaking below this target level. Assuring ourselves this was just one of these things, our secondary target came to fruition a couple of weeks later, the German index again gapped down to our target level.

Happening once could easily be written off as coincidence. When this nonsense happened again within such a short timeframe, it became clear our software had been mapping the correct trend. And the manipulation gaps strongly suggested the market wanted the German index pretty firmly below our logical target levels, hence manipulation gapping the index downward. The DAX was to eventually bottom around 8,250 points in the middle of May.

Paradoxically, this forced reversal has given voice to another, usually erroneous, stock market cliché.

Every now and then, someone will advance the theory of something needing to go down before it can go up. Most folks, anxiously clutching shares where the price is trashed, face a fruitless period of years, if awaiting an inevitable price recovery. But there can be a kernel of truth in the saying. If something has crashed illogically, then is given reason for a rise, the results can prove flamboyant when the value of an overcooked drop is, essentially, paid back.

We believe this is happening with the DAX and suspect the index shall prove capable of an attempt at further all time highs.

The index is closing on what we think shall be an important trigger level. Presently trading around 15,640 points, the DAX needs exceed 15,670 to give some early warning for some reasonable movement. We can calculate 15,966 points as our initial target. If bettered, a longer term cycle toward 17,488 points calculates as possible and we suspect some market hesitation, should such an amazing number make an appearance.

For everything to start going convincingly wrong for German, the index needs break Red, roughly at 14,700 points. Such a scenario risks a tumble to the 14,000 level, perhaps even 13,100 points.

FUTURES

| Time Issued | Market | Price At Issue | Short Entry | Fast Exit | Slow Exit | Stop | Long Entry | Fast Exit | Slow Exit | Stop | Prior |

| 10:13:43PM | BRENT | 74.49 | 73.97 | ‘cess | |||||||

| 10:15:30PM | GOLD | 1779 | 1773 | ||||||||

| 10:21:30PM | FTSE | 7088.52 | 7049 | 7040 | 7021 | 7099 | 7099 | 7119 | 7143 | 7049 | |

| 10:23:22PM | FRANCE | 6606 | |||||||||

| 10:25:24PM | GERMANY | 15634 | |||||||||

| 10:34:02PM | US500 | 4248.37 | ‘cess | ||||||||

| 10:36:14PM | DOW | 33991.9 | ‘cess | ||||||||

| 10:37:58PM | NASDAQ | 14284 | Success | ||||||||

| 10:39:45PM | JAPAN | 28846 | 28629 | 28537 | 28415 | 28815 | 28874 | 28914 | 29009 | 28776 |

/06/2021 FTSE Closed at 7090 points. Change of 0.4%. Total value traded through LSE was: £ 4,614,657,268 a change of -14.59%

21/06/2021 FTSE Closed at 7062 points. Change of 0.64%. Total value traded through LSE was: £ 5,402,713,223 a change of -54.05%

18/06/2021 FTSE Closed at 7017 points. Change of -1.9%. Total value traded through LSE was: £ 11,756,764,970 a change of 103.69%

17/06/2021 FTSE Closed at 7153 points. Change of -0.43%. Total value traded through LSE was: £ 5,772,023,987 a change of -2.72%

16/06/2021 FTSE Closed at 7184 points. Change of 0.17%. Total value traded through LSE was: £ 5,933,708,307 a change of 0.36%

15/06/2021 FTSE Closed at 7172 points. Change of 0.36%. Total value traded through LSE was: £ 5,912,147,960 a change of 2.11%

14/06/2021 FTSE Closed at 7146 points. Change of 0.17%. Total value traded through LSE was: £ 5,789,732,909 a change of 12.95%

SUCCESS above means both FAST & SLOW targets were met. ‘CESS means just the FAST target met and probably the next time it is exceeded, movement to the SLOW target shall commence.

Our commentary is in two sections. Immediately below are today’s updated comments. If our commentary remains valid, the share can be found in the bottom section which has a RED heading. Hopefully, this will mean you no longer need to flip back through previous reports. HYPERLINKS DISABLED IN THIS VERSION

Please remember, all prices are mid-price (halfway between the Buy and Sell). When we refer to a price CLOSING above a specific level, we are viewing the point where we can regard a trend as changing. Otherwise, we are simply speculating on near term trading targets. Our website is www.trendsandtargets.com.

UPDATE. We often give an initial and a secondary price. If the initial is exceeded, we still expect it to fall back but the next time the initial is bettered, the price should continue to the secondary. The converse it true with price drops.

We can be contacted at info@trendsandtargets.com. Spam filters set to maximum so only legit emails get through…

Section One – Outlook Updated Today. Click here for Section Two – Outlook Remains Valid shares

Click Epic to jump to share: LSE:AGM Applied Graphene** **LSE:AML Aston Martin** **LSE:AVCT Avacta** **LSE:CASP Caspian** **LSE:HL. Hargreaves Lansdown** **LSE:ITRK Intertek** **LSE:ODX Omega Diags** **LSE:OPG OPG Power Ventures** **LSE:STAN Standard Chartered** **LSE:TSCO Tesco** **

********

Updated charts published on : Applied Graphene, Aston Martin, Avacta, Caspian, Hargreaves Lansdown, Intertek, Omega Diags, OPG Power Ventures, Standard Chartered, Tesco,

LSE:AGM Applied Graphene Close Mid-Price: 25.2 Percentage Change: -9.19% Day High: 27.75 Day Low: 25.5

If Applied Graphene experiences continued weakness below 25.5, it will in ……..

</p

View Previous Applied Graphene & Big Picture ***

LSE:AML Aston Martin Close Mid-Price: 1903 Percentage Change: -1.63% Day High: 1922.5 Day Low: 1840

Target met. Weakness on Aston Martin below 1840 will invariably lead to 1 ……..

</p

View Previous Aston Martin & Big Picture ***

LSE:AVCT Avacta Close Mid-Price: 167 Percentage Change: -8.24% Day High: 179 Day Low: 159

Target met. Continued weakness against AVCT taking the price below 159 ca ……..

</p

View Previous Avacta & Big Picture ***

LSE:CASP Caspian. Close Mid-Price: 2.6 Percentage Change: + 8.33% Day High: 2.73 Day Low: 2.4

Continued trades against CASP with a mid-price ABOVE 2.73 should improve ……..

</p

View Previous Caspian & Big Picture ***

LSE:HL. Hargreaves Lansdown Close Mid-Price: 1588 Percentage Change: -2.64% Day High: 1634 Day Low: 1577

Target met. If Hargreaves Lansdown experiences continued weakness below 1 ……..

</p

View Previous Hargreaves Lansdown & Big Picture ***

LSE:ITRK Intertek. Close Mid-Price: 5586 Percentage Change: + 0.04% Day High: 5612 Day Low: 5562

This, surprisingly, remains moderately hopeful. Strength now exceeding 563 ……..

</p

View Previous Intertek & Big Picture ***

LSE:ODX Omega Diags Close Mid-Price: 54 Percentage Change: -2.70% Day High: 55.5 Day Low: 49.6

Target met. If Omega Diags experiences continued weakness below 49.6, it ……..

</p

View Previous Omega Diags & Big Picture ***

LSE:OPG OPG Power Ventures Close Mid-Price: 14 Percentage Change: -1.41% Day High: 14.68 Day Low: 14.12

Continued weakness against OPG taking the price below 14.12 calculates as ……..

</p

View Previous OPG Power Ventures & Big Picture ***

LSE:STAN Standard Chartered Close Mid-Price: 466.1 Percentage Change: -1.17% Day High: 473 Day Low: 463.6

This has made a dodgy movement, closing the session in a position which su ……..

</p

View Previous Standard Chartered & Big Picture ***

LSE:TSCO Tesco Close Mid-Price: 224.2 Percentage Change: -0.62% Day High: 226.55 Day Low: 224

Tesco continues to placidly do nothing interesting. Below 221 suggests com ……..

</p

View Previous Tesco & Big Picture ***