#Nasdaq #SP500

When we previously reviewed #Sareum, we suggested the share price needed close above 9.45p to suggest good things ahead for the future. Alas, despite the share price achieving our primary AND secondary targets intraday, the highest closing price achieved was slightly short at 9.3p. The rest, as they say, is history. Currently trading at 140p, only thanks to a 50:1 share split, this price conceals the salient detail the price is really trading at just 2.7p in old money.

Over the years, we’ve learned to distrust share splits, when the manoeuvre is designed to make a penny share sound more respectable. Invariably, this simply places the price in a position where the market can again edge the price back downhill. At this point, Sareum has only experienced just over a month of trading at “respectable” levels but unless some miracle permits the share to close a session above the Blue downtrend on the chart (189.949p at time of writing), we’re not exactly bubbling over with optimism.

It’s truly strange how this situation tends dominate in the UK, whereas in the US, converse movements promote optimism which is usually justified. Regardless whether it’s Apple and their repeat splits or Tesla with its most recent 1:5 split, or even Google with their 1:2 split back in 2014, the longer term consequences of these efforts to make a share price sound cheaper always seem to pay off for the investor.

Perhaps Sareum shall break the mould as visually the share price isn’t miles away from the downtrend and there are already suggestions for some positive movement. Now above just 148p should prove capable of triggering price recovery to an initial 183p. As the chart highlights, such a target is a nod and a wink away from the ruling downtrend and therefore, hints at the potential for closure above the trend in the weeks ahead. Our secondary in such an instance calculates at 227p, along with a visual threat for some hesitation due to a prior high.

On the converse side, the price needs trade below 115p to justify some real alarm. The 115p level is a Big Picture thing and movement below risks nudging open the gates of panic. Below 115p and we can calculate a hopeful bottom of 84p and that’s it. In the limbo dance of share prices, we cannot work out any targets below such a level without introducing minus signs.

To end on an optimistic note, we previously enjoyed reading about Sareum’s area of operations and remain impressed with their approach. Hopefully at such stage this shall be reflected in their share price.

FUTURES

| Time Issued | Market | Price At Issue | Short Entry | Fast Exit | Slow Exit | Stop | Long Entry | Fast Exit | Slow Exit | Stop | Prior |

| 9:08:55PM | BRENT | 101.65 | Success | ||||||||

| 9:15:36PM | GOLD | 1926.12 | |||||||||

| 9:17:55PM | FTSE | 7592.13 | |||||||||

| 9:32:14PM | FRANCE | 6494.5 | Success | ||||||||

| 9:34:02PM | GERMANY | 14141 | Success | ||||||||

| 9:36:12PM | US500 | 4480.57 | 4459 | 4422 | 4377 | 4512 | 4532 | 4544 | 4576 | 4500 | Success |

| 9:38:36PM | DOW | 34472.1 | ‘cess | ||||||||

| 9:40:49PM | NASDAQ | 14497 | 14394 | 14282 | 14174 | 14579 | 14749 | 14773 | 14900 | 14575 | Success |

| 9:46:30PM | JAPAN | 27098 | Success |

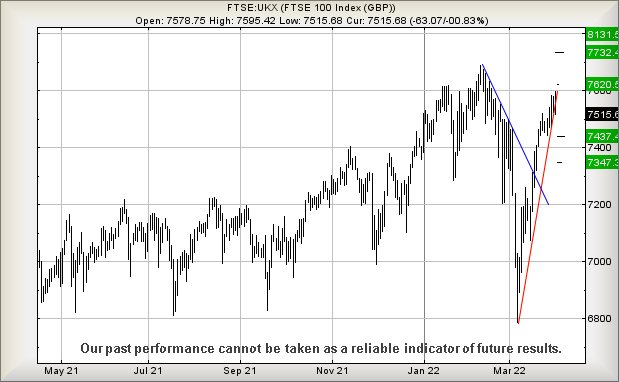

6/04/2022 FTSE Closed at 7587 points. Change of -0.34%. Total value traded through LSE was: £ 7,373,306,998 a change of -8.37%

5/04/2022 FTSE Closed at 7613 points. Change of 0.73%. Total value traded through LSE was: £ 8,046,795,473 a change of 61.76%

4/04/2022 FTSE Closed at 7558 points. Change of 0.28%. Total value traded through LSE was: £ 4,974,492,195 a change of -8.16%

1/04/2022 FTSE Closed at 7537 points. Change of 0.29%. Total value traded through LSE was: £ 5,416,602,044 a change of -16.69%

31/03/2022 FTSE Closed at 7515 points. Change of -0.83%. Total value traded through LSE was: £ 6,501,691,261 a change of -12.58%

30/03/2022 FTSE Closed at 7578 points. Change of 0.54%. Total value traded through LSE was: £ 7,437,044,011 a change of -7.97%

29/03/2022 FTSE Closed at 7537 points. Change of 0.86%. Total value traded through LSE was: £ 8,081,315,259 a change of 39.66%

SUCCESS above means both FAST & SLOW targets were met. ‘CESS means just the FAST target met and probably the next time it is exceeded, movement to the SLOW target shall commence.

Our commentary is in two sections. Immediately below are today’s updated comments. If our commentary remains valid, the share can be found in the bottom section which has a RED heading. Hopefully, this will mean you no longer need to flip back through previous reports. HYPERLINKS DISABLED IN THIS VERSION

Please remember, all prices are mid-price (halfway between the Buy and Sell). When we refer to a price CLOSING above a specific level, we are viewing the point where we can regard a trend as changing. Otherwise, we are simply speculating on near term trading targets. Our website is www.trendsandtargets.com.

UPDATE. We often give an initial and a secondary price. If the initial is exceeded, we still expect it to fall back but the next time the initial is bettered, the price should continue to the secondary. The converse it true with price drops.

We can be contacted at info@trendsandtargets.com. Spam filters set to maximum so only legit emails get through…

Section One – Outlook Updated Today. Click here for Section Two – Outlook Remains Valid shares

Click Epic to jump to share: LSE:AZN Astrazeneca** **LSE:BARC Barclays** **LSE:DDDD 4D Pharma** **LSE:DGE Diageo** **LSE:GENL Genel** **LSE:GLEN Glencore Xstra** **LSE:IGAS Igas Energy** **LSE:NG. National Glib** **LSE:ODX Omega Diags** **LSE:PHP Primary Health** **LSE:RMG Royal Mail** **LSE:TSCO Tesco** **

********

Updated charts published on : Astrazeneca, Barclays, 4D Pharma, Diageo, Genel, Glencore Xstra, Igas Energy, National Glib, Omega Diags, Primary Health, Royal Mail, Tesco,

LSE:AZN Astrazeneca. Close Mid-Price: 10462 Percentage Change: + 1.24% Day High: 10470 Day Low: 10230

Target met. Further movement against Astrazeneca ABOVE 10470 should impro ……..

</p

View Previous Astrazeneca & Big Picture ***

LSE:BARC Barclays Close Mid-Price: 143.34 Percentage Change: -2.49% Day High: 148.06 Day Low: 141.56

If Barclays experiences continued weakness below 141.56, it will invariab ……..

</p

View Previous Barclays & Big Picture ***

LSE:DDDD 4D Pharma Close Mid-Price: 37.6 Percentage Change: -2.84% Day High: 41.05 Day Low: 36.5

Weakness on 4D Pharma below 36.5 will invariably lead to 29 with secondar ……..

</p

View Previous 4D Pharma & Big Picture ***

LSE:DGE Diageo. Close Mid-Price: 4011 Percentage Change: + 0.79% Day High: 4039.5 Day Low: 3979.5

All Diageo needs are mid-price trades ABOVE 4039.5 to improve acceleratio ……..

</p

View Previous Diageo & Big Picture ***

LSE:GENL Genel. Close Mid-Price: 194.6 Percentage Change: + 1.88% Day High: 197.8 Day Low: 188.2

Further movement against Genel ABOVE 197.8 should improve acceleration to ……..

</p

View Previous Genel & Big Picture ***

LSE:GLEN Glencore Xstra. Close Mid-Price: 518.6 Percentage Change: + 0.35% Day High: 518.9 Day Low: 506.8

All Glencore Xstra needs are mid-price trades ABOVE 518.9 to improve acce ……..

</p

View Previous Glencore Xstra & Big Picture ***

LSE:IGAS Igas Energy. Close Mid-Price: 44.3 Percentage Change: + 0.23% Day High: 48 Day Low: 38

Further movement against Igas Energy ABOVE 48 should improve acceleration ……..

</p

View Previous Igas Energy & Big Picture ***

LSE:NG. National Glib. Close Mid-Price: 1221.5 Percentage Change: + 0.87% Day High: 1221.5 Day Low: 1197.5

In the event of National Glib enjoying further trades beyond 1221.5, the ……..

</p

View Previous National Glib & Big Picture ***

LSE:ODX Omega Diags. Close Mid-Price: 5.6 Percentage Change: + 5.66% Day High: 5.65 Day Low: 5.05

All Omega Diags needs are mid-price trades ABOVE 5.65 to improve accelera ……..

</p

View Previous Omega Diags & Big Picture ***

LSE:PHP Primary Health Close Mid-Price: 150.9 Percentage Change: -0.07% Day High: 151.6 Day Low: 150.3

Further movement against Primary Health ABOVE 151.6 should improve accele ……..

</p

View Previous Primary Health & Big Picture ***

LSE:RMG Royal Mail Close Mid-Price: 328.3 Percentage Change: -1.26% Day High: 332.5 Day Low: 317.2

Target met. If Royal Mail experiences continued weakness below 317.2, it ……..

</p

View Previous Royal Mail & Big Picture ***

LSE:TSCO Tesco Close Mid-Price: 272.7 Percentage Change: -0.73% Day High: 274.7 Day Low: 269.2

Weakness on Tesco below 269.2 will invariably lead to 262 with secondary, ……..

</p

View Previous Tesco & Big Picture ***