#FTSE #Nasdaq

A colonoscopy is probably pretty high on the list of things blokes don’t talk about. While undergoing one on Friday, the subject of Rentokil drifted into my addled brain as I watched the live video showing what was happening inside. The idea of a film camera, a laser, and garden shears being guided up ones nether region was horrific but this is the reality we all face, once past the age of 50 and a health service determined to protect people. A bowel cancer test, routine every two years, revealed something questionable, but with 95% of results being ‘false positives’, real terror came from the concept of what the procedure entailed.

To be utterly truthful, the worst slight discomfort came from the needle administering local anaesthetic, rapidly forgotten while a fascinating hunt for what looked like wild mushrooms inside the colon took place. When one was found, it was chopped down, then cauterised with a laser. There was no pain, despite the brutal war being waged internally, and eventually the film crew exploring my colon engaged reverse gear, their enemy defeated. The exercise was a “false positive”, samples taken revealing something called polyps, essentially skin tags. It all felt very routine except for the genius idea which allowed the patient a live action view. The last time I’d seen anything like this, I’d been watching a Rentokil guy feeding a probe along a cavity wall.

Of course, thanks to an anaesthetic high, I started to question why Rentokil don’t offer such a scanning service to the NHS. The idea of one of their distinctive vans pulling up, the driver telling a patient to just bend over, and…. You get the idea. And the real message is, unlike the writer, don’t panic at the thought of such a procedure. Getting your teeth cleaned is substantially worse in terms of discomfort.

Once the drugs wore off, the idea of reviewing Rentokil share price remained as it’s been a while and doubtless, with a return to offices, the company should surely experience an upsurge in business.

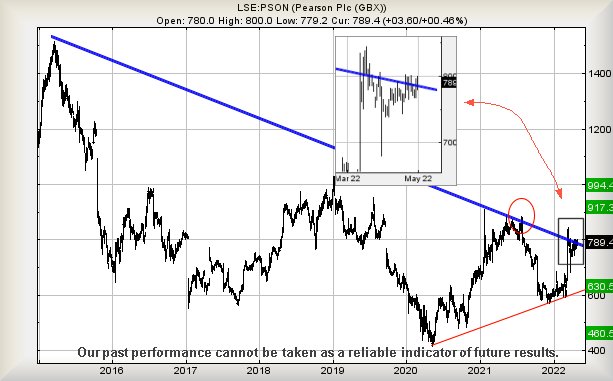

Currently, Rentokil share price doesn’t entirely share my optimism for their future. It appears weakness below 508p risks triggering some near term reversal down to an initial 493p with secondary, if broken, down at 472p and a very probable bottom. Curiously, it feels like overall market conditions are presently inhibiting the share price as above 550p (Blue) is supposed to trigger imminent recovery to an initial 609 with secondary, if bettered, at 627p and some hesitation.

In terms of panic, we’d certainly have concerns should the price manage to close a session below 472p. This risks being quite problematic, signalling the potential of reversal to a trend breaking 445p, unfortunately finding itself in a zone where an eventual bottom at 261p calculates as possible. For now, we suspect 472p shall prove to be an eventual bounce point and thus, suspect this shall be a share worth watching.

Unlike the live video feed from my colonoscopy! (shudder)

FUTURES

| Time Issued | Market | Price At Issue | Short Entry | Fast Exit | Slow Exit | Stop | Long Entry | Fast Exit | Slow Exit | Stop | Prior |

| 10:13:00PM | BRENT | 101.37 | ‘cess | ||||||||

| 10:14:48PM | GOLD | 1838.35 | Success | ||||||||

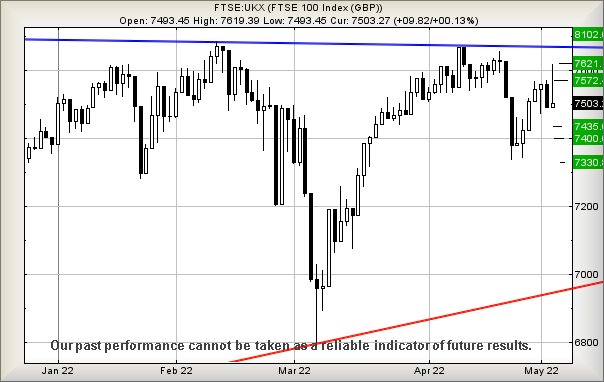

| 10:17:41PM | FTSE | 7256.85 | 7192 | 7152 | 7098 | 7245 | 7315 | 7346 | 7412 | 7245 | Shambles |

| 10:19:11PM | FRANCE | 6144.2 | |||||||||

| 10:21:14PM | GERMANY | 13572 | |||||||||

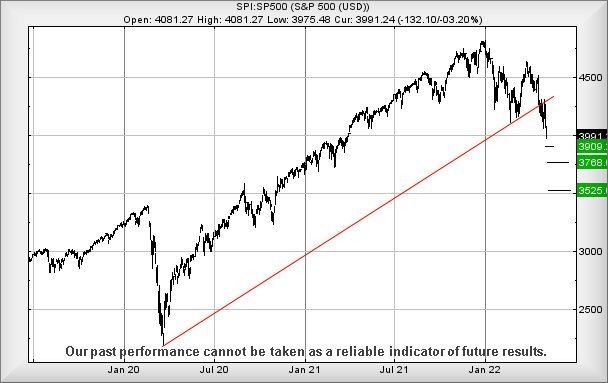

| 10:23:08PM | US500 | 3997.17 | ‘cess | ||||||||

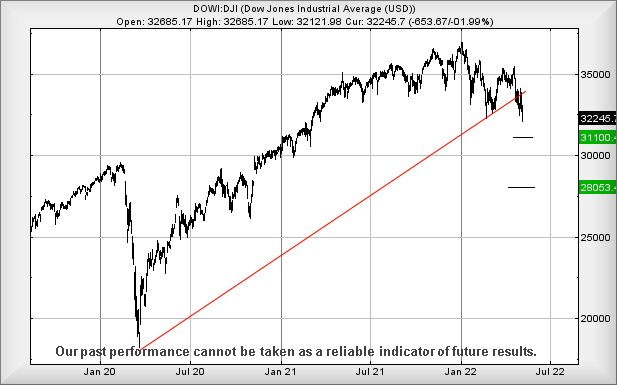

| 10:25:24PM | DOW | 32140.7 | ‘cess | ||||||||

| 10:27:14PM | NASDAQ | 12332.79 | 12102 | 11970 | 11777 | 12300 | 12549 | 12584 | 12746 | 12387 | Success |

| 10:32:17PM | JAPAN | 26061 |

10/05/2022 FTSE Closed at 7243 points. Change of 0.37%. Total value traded through LSE was: £ 6,416,543,760 a change of 2.54%

9/05/2022 FTSE Closed at 7216 points. Change of -2.31%. Total value traded through LSE was: £ 6,257,631,157 a change of -11.88%

6/05/2022 FTSE Closed at 7387 points. Change of -1.55%. Total value traded through LSE was: £ 7,100,975,536 a change of 2.72%

5/05/2022 FTSE Closed at 7503 points. Change of 0.13%. Total value traded through LSE was: £ 6,912,828,845 a change of 20.87%

4/05/2022 FTSE Closed at 7493 points. Change of -0.9%. Total value traded through LSE was: £ 5,719,365,474 a change of -24.49%

3/05/2022 FTSE Closed at 7561 points. Change of 0.23%. Total value traded through LSE was: £ 7,574,559,700 a change of 8.37%

29/04/2022 FTSE Closed at 7544 points. Change of -100%. Total value traded through LSE was: £ 6,989,742,428 a change of 0%

SUCCESS above means both FAST & SLOW targets were met. ‘CESS means just the FAST target met and probably the next time it is exceeded, movement to the SLOW target shall commence.

Our commentary is in two sections. Immediately below are today’s updated comments. If our commentary remains valid, the share can be found in the bottom section which has a RED heading. Hopefully, this will mean you no longer need to flip back through previous reports. HYPERLINKS DISABLED IN THIS VERSION

Please remember, all prices are mid-price (halfway between the Buy and Sell). When we refer to a price CLOSING above a specific level, we are viewing the point where we can regard a trend as changing. Otherwise, we are simply speculating on near term trading targets. Our website is www.trendsandtargets.com.

UPDATE. We often give an initial and a secondary price. If the initial is exceeded, we still expect it to fall back but the next time the initial is bettered, the price should continue to the secondary. The converse it true with price drops.

We can be contacted at info@trendsandtargets.com. Spam filters set to maximum so only legit emails get through…

Section One – Outlook Updated Today. Click here for Section Two – Outlook Remains Valid shares

Click Epic to jump to share: LSE:AML Aston Martin** **LSE:CBX Cellular Goods** **LSE:CCL Carnival** **LSE:DDDD 4D Pharma** **LSE:EZJ EasyJet** **LSE:IAG British Airways** **LSE:ITM ITM Power** **LSE:JET Just Eat** **LSE:OXIG Oxford Instruments** **

********

Updated charts published on : Aston Martin, Cellular Goods, Carnival, 4D Pharma, EasyJet, British Airways, ITM Power, Just Eat, Oxford Instruments,

LSE:AML Aston Martin Close Mid-Price: 680 Percentage Change: -9.14% Day High: 777.2 Day Low: 680

Target met. Weakness on Aston Martin below 680 will invariably lead to 63 ……..

</p

View Previous Aston Martin & Big Picture ***

LSE:CBX Cellular Goods Close Mid-Price: 2.1 Percentage Change: -4.55% Day High: 2.15 Day Low: 2.1

Target met. In the event Cellular Goods experiences weakness below 2.1 it ……..

</p

View Previous Cellular Goods & Big Picture ***

LSE:CCL Carnival Close Mid-Price: 1044.5 Percentage Change: -2.75% Day High: 1105 Day Low: 1032

In the event Carnival experiences weakness below 1032 it calculates with ……..

</p

View Previous Carnival & Big Picture ***

LSE:DDDD 4D Pharma Close Mid-Price: 34.55 Percentage Change: -4.69% Day High: 38 Day Low: 34

If 4D Pharma experiences continued weakness below 34, it will invariably ……..

</p

View Previous 4D Pharma & Big Picture ***

LSE:EZJ EasyJet Close Mid-Price: 490.3 Percentage Change: -0.35% Day High: 503.6 Day Low: 485.6

Weakness on EasyJet below 485.6 will invariably lead to 430 next and seco ……..

</p

View Previous EasyJet & Big Picture ***

LSE:IAG British Airways Close Mid-Price: 123.02 Percentage Change: -3.47% Day High: 130.08 Day Low: 123.34

Continued weakness against IAG taking the price below 123.34 calculates a ……..

</p

View Previous British Airways & Big Picture ***

LSE:ITM ITM Power Close Mid-Price: 268.9 Percentage Change: -2.92% Day High: 288.5 Day Low: 267.3

In the event ITM Power experiences weakness below 267.3 it calculates wit ……..

</p

View Previous ITM Power & Big Picture ***

LSE:JET Just Eat Close Mid-Price: 1534.2 Percentage Change: -3.56% Day High: 1671.8 Day Low: 1519.4

Continued weakness against JET taking the price below 1519.4 calculates a ……..

</p

View Previous Just Eat & Big Picture ***

LSE:OXIG Oxford Instruments Close Mid-Price: 2115 Percentage Change: -1.17% Day High: 2170 Day Low: 2085

Weakness on Oxford Instruments below 2085 will invariably lead to 1990 wi ……..

</p

View Previous Oxford Instruments & Big Picture ***