#Stoxx #Dow

A chum is visiting this week for some medical recovery time. He’s long had an ambition of panning for gold in our garden stream, due apparently to the presence of significant quantities of quartz and black magnetic sand. Both items, when found together, tick a box to indicate the presence of gold. While a quick Google check also revealed quartz and iron represent the two most comment mineral and element on the planet, he’s been having a great time with his gold panning kit.

To spice things up, it seemed a good idea to paint some pieces of lead gold and hide them in the stream. If he successfully found the lead, there was a chance his panning technique might also be correct. To both our amazement, he indeed discovered the lead, along with a two tiny specs of gold. As this was clearly a signal to “ramp things up”, he spent the afternoon with a hand trowel, digging at the bottom of the waterfall and depositing the dirt in a bucket. This evening, between countless cups of tea and lots of chocolate, he’s been panning the bucket of gravel without any eureka moments, also making plans to spend Thursday above the waterfall as there’s a large natural pool which “must” have trapped gold over the millennia. This is all because of two flecks of gold… greed being a familiar motivation which will be recognised by those who’ve watched TV’s Gold Rush & Bering Sea Gold shows.

Mining is a strange business.

It was with a heavy heart, I approached Ben’s Creek Group for analysis, pleased to discover they are mining for coal, also making sure everyone visiting their website knows they are producing Coal for Steel and not, Coal for Power. This is presumably due to the bad PR coal power stations receive but metallurgical coal is a critical component in the production of steel. The company are listed in the UK Aim market, owning and operating coal mines in North America. Needless to say, they own Ben’s Creek mining project in West Virginia, USA.

The company share price has enacted a fairly typical initial rise, following their launch last year. After a brief look above 100p, it has also enacted a fairly typical reversal, giving many signs the market really doesn’t want the price to fall lower. In an almost obligatory wealth warning, we can calculate trades below 30p risk digging a hole down to an initial 26p with secondary, if broken, at 20.5p. We’re making quite a big deal out of this as we cannot calculate anything below 20.5p which doesn’t involve the use of minus signs. While this is obviously impossible, the danger below 20.5p is of the share price finding itself enmeshed in misery and unable to recover, a bit like a UK voter when they listen to anything the new PM says.

If we choose to take encouragement from the close attention being paid to the Red uptrend, movement now above just 39p works out with an initial target of 42.4p with secondary, if bettered, a longer term 53p. For numbers above the 53p level, we shall need review the tea leaves again for this share’ future potentials.

FUTURES

| Time Issued | Market | Price At Issue | Short Entry | Fast Exit | Slow Exit | Stop | Long Entry | Fast Exit | Slow Exit | Stop | Prior |

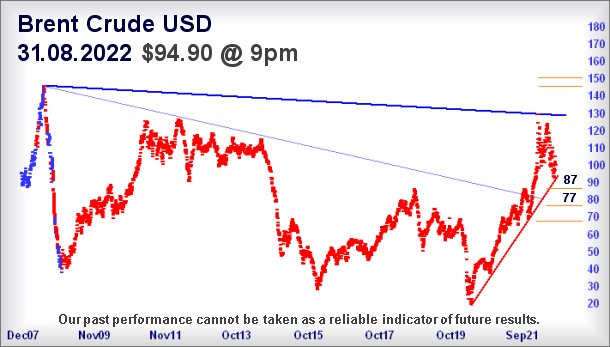

| 9:29:10PM | BRENT | 87.46 | Success | ||||||||

| 9:31:25PM | GOLD | 1717.81 | ‘cess | ||||||||

| 9:33:25PM | FTSE | 7251.41 | Success | ||||||||

| 9:37:01PM | STOX50 | 3523.3 | 3456 | 3430 | 3399 | 3493 | 3523 | 3543 | 3575 | 3493 | |

| 9:41:47PM | GERMANY | 12992 | |||||||||

| 9:43:55PM | US500 | 3980 | |||||||||

| 9:46:43PM | DOW | 31583 | 31156 | 31082 | 30891 | 31355 | 31655 | 31680 | 31917 | 31400 | Success |

| 9:49:13PM | NASDAQ | 12261 | ‘cess | ||||||||

| 9:51:08PM | JAPAN | 27712 |

7/09/2022 FTSE Closed at 7237 points. Change of -0.86%. Total value traded through LSE was: £ 7,407,245,342 a change of 30.74%

6/09/2022 FTSE Closed at 7300 points. Change of 0.18%. Total value traded through LSE was: £ 5,665,778,730 a change of 28.88%

5/09/2022 FTSE Closed at 7287 points. Change of 0.08%. Total value traded through LSE was: £ 4,396,051,138 a change of -10.86%

2/09/2022 FTSE Closed at 7281 points. Change of 1.86%. Total value traded through LSE was: £ 4,931,431,269 a change of -2.21%

1/09/2022 FTSE Closed at 7148 points. Change of -1.87%. Total value traded through LSE was: £ 5,042,745,604 a change of -38.48%

31/08/2022 FTSE Closed at 7284 points. Change of -1.05%. Total value traded through LSE was: £ 8,197,472,854 a change of 27.31%

30/08/2022 FTSE Closed at 7361 points. Change of -100%. Total value traded through LSE was: £ 6,438,857,207 a change of 0%

SUCCESS above means both FAST & SLOW targets were met. ‘CESS means just the FAST target met and probably the next time it is exceeded, movement to the SLOW target shall commence.

Our commentary is in two sections. Immediately below are today’s updated comments. If our commentary remains valid, the share can be found in the bottom section which has a RED heading. Hopefully, this will mean you no longer need to flip back through previous reports. HYPERLINKS DISABLED IN THIS VERSION

Please remember, all prices are mid-price (halfway between the Buy and Sell). When we refer to a price CLOSING above a specific level, we are viewing the point where we can regard a trend as changing. Otherwise, we are simply speculating on near term trading targets. Our website is www.trendsandtargets.com.

UPDATE. We often give an initial and a secondary price. If the initial is exceeded, we still expect it to fall back but the next time the initial is bettered, the price should continue to the secondary. The converse it true with price drops.

We can be contacted at info@trendsandtargets.com. Spam filters set to maximum so only legit emails get through…

Section One – Outlook Updated Today. Click here for Section Two – Outlook Remains Valid shares

Click Epic to jump to share: LSE:BBY BALFOUR BEATTY** **LSE:ITM ITM Power** **LSE:PPC President Energy** **LSE:QFI Quadrise** **LSE:SCLP Scancell** **LSE:VOD Vodafone** **

********

Updated charts published on : BALFOUR BEATTY, ITM Power, President Energy, Quadrise, Scancell, Vodafone,

LSE:BBY BALFOUR BEATTY. Close Mid-Price: 328.6 Percentage Change: + 0.00% Day High: 332.4 Day Low: 326.6

Traffic now ^above 333 should built toward an initial 343 with secondary, ……..

</p

View Previous BALFOUR BEATTY & Big Picture ***

LSE:ITM ITM Power Close Mid-Price: 163.55 Percentage Change: -4.50% Day High: 164.95 Day Low: 154.8

Target Met. Now below 154 should be an issue, calculating with the potenti ……..

</p

View Previous ITM Power & Big Picture ***

LSE:PPC President Energy Close Mid-Price: 1.22 Percentage Change: -4.31% Day High: 1.25 Day Low: 1.18

Below 1.18 now suggests the potential of travel down to an initial 1.11 wi ……..

</p

View Previous President Energy & Big Picture ***

LSE:QFI Quadrise Close Mid-Price: 1.12 Percentage Change: -9.68% Day High: 1.23 Day Low: 1.12

Target Met. Now below 1.12 looks capable of reversal to an initial 0.67 wi ……..

</p

View Previous Quadrise & Big Picture ***

LSE:SCLP Scancell Close Mid-Price: 11 Percentage Change: -2.22% Day High: 11.5 Day Low: 11

Weakness on Scancell below 11 will invariably lead to 9p. If broken, our s ……..

</p

View Previous Scancell & Big Picture ***

LSE:VOD Vodafone Close Mid-Price: 110.18 Percentage Change: -2.65% Day High: 112.98 Day Low: 110.32

Target Met. Further weakness below 110 now indicates the potential of 104p ……..

</p

View Previous Vodafone & Big Picture ***