#Brent #Stoxx50

Last week, we mentioned a chum who’s been spending his recovery time (heart bypass) lazily panning for gold in our garden stream. He’s finally returned home, along with a total of 6 tiny flakes of something golden coloured. Unfortunately, he also managed a little adventure, ascending the 7 metre cliff and taking a hard look at the stream gully. We’ve been lectured on where all the real gold must be trapped as he plans to visit again in a few months, getting serious with the job.

Trying to advise our gently babbling brook can prove less friendly, now the rains have started, didn’t convince him. But the roar of the waterfall on Sunday morning perhaps did the job, a conclusive rainfall during the night serving to make the little gurgling stream less friendly. Unfortunately, he discovered a natural dam above the waterfall and convinced himself this is where Mother Nature has been storing all her Gold for him to collect. Even once he recovers, the concept of fighting a strong current while digging 100’s of years of sediment sounds like an impossible task and we privately suspect his personal Gold Rush shall be delayed until May or June next year, when it’s again summer time here in Argyll.

However, there are early signs Gold may be found elsewhere as the UK markets are starting to look unusually positive.

Lloyds Bank share price is a case in point.

Three weeks ago, we’d felt the share needed trade above 47.3p to suggest happier times were ahead but the most recent four sessions are giving early signals for some slight hope. The immediate situation suggests traffic above 46.40p should now prove useful, calculating with the potential of generating a lift to 48.25p next. Visually, this looks extremely significant and allows us to present a secondary ambition at 51.4p. Once again, the visuals are interesting with this secondary target as it coincides with the downtrend since 2019, presenting itself as an ideal level where some hesitation should be anticipated.

Certainly, despite it proving easy to produce 62p as a third level target, we feel our 51.4p shall almost certainly provoke a stutter in a rising cycle.

For everything to go wrong, Lloyds share price needs drop below Red (presently 42.7p) as this threatens reversal to 40.5p and hopefully a bounce.

FUTURES

| Time Issued | Market | Price At Issue | Short Entry | Fast Exit | Slow Exit | Stop | Long Entry | Fast Exit | Slow Exit | Stop |

| 10:17:15PM | BRENT | 91.92 | 90.7 | 90.385 | 89.61 | 91.67 | 92.71 | 93.1175 | 94 | 91.7 |

| 10:18:44PM | GOLD | 1717.83 | 1719 | |||||||

| 10:21:52PM | FTSE | 7384.77 | 7343 | |||||||

| 10:23:49PM | STOX50 | 3583 | 3557 | 3552 | 3541 | 3577 | 3585 | 3610 | 3671 | 3555 |

| 10:25:45PM | GERMANY | 13128 | 13074 | |||||||

| 10:28:39PM | US500 | 4066.27 | 4008 | |||||||

| 10:31:04PM | DOW | 32160 | 32118 | |||||||

| 10:33:42PM | NASDAQ | 12585 | 12506 | |||||||

| 10:40:21PM | JAPAN | 28409 | 28206 |

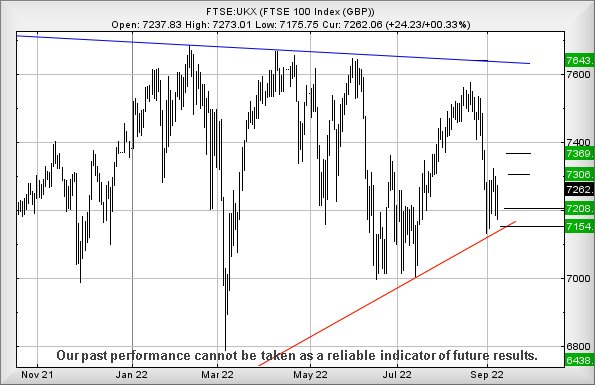

9/09/2022 FTSE Closed at 7351 points. Change of 1.23%. Total value traded through LSE was: £ 5,351,894,776 a change of 1.51%

8/09/2022 FTSE Closed at 7262 points. Change of 0.35%. Total value traded through LSE was: £ 5,272,168,524 a change of -28.82%

7/09/2022 FTSE Closed at 7237 points. Change of -0.86%. Total value traded through LSE was: £ 7,407,245,342 a change of 30.74%

6/09/2022 FTSE Closed at 7300 points. Change of 0.18%. Total value traded through LSE was: £ 5,665,778,730 a change of 28.88%

5/09/2022 FTSE Closed at 7287 points. Change of 0.08%. Total value traded through LSE was: £ 4,396,051,138 a change of -10.86%

2/09/2022 FTSE Closed at 7281 points. Change of 1.86%. Total value traded through LSE was: £ 4,931,431,269 a change of -2.21%

1/09/2022 FTSE Closed at 7148 points. Change of -1.87%. Total value traded through LSE was: £ 5,042,745,604 a change of -38.48%

SUCCESS above means both FAST & SLOW targets were met. ‘CESS means just the FAST target met and probably the next time it is exceeded, movement to the SLOW target shall commence.

Our commentary is in two sections. Immediately below are today’s updated comments. If our commentary remains valid, the share can be found in the bottom section which has a RED heading. Hopefully, this will mean you no longer need to flip back through previous reports. HYPERLINKS DISABLED IN THIS VERSION

Please remember, all prices are mid-price (halfway between the Buy and Sell). When we refer to a price CLOSING above a specific level, we are viewing the point where we can regard a trend as changing. Otherwise, we are simply speculating on near term trading targets. Our website is www.trendsandtargets.com.

UPDATE. We often give an initial and a secondary price. If the initial is exceeded, we still expect it to fall back but the next time the initial is bettered, the price should continue to the secondary. The converse it true with price drops.

We can be contacted at info@trendsandtargets.com. Spam filters set to maximum so only legit emails get through…

Section One – Outlook Updated Today. Click here for Section Two – Outlook Remains Valid shares

Click Epic to jump to share: LSE:CAR Carclo** **LSE:DARK Darktrace Plc** **LSE:RBD Reabold Resources PLC** **LSE:SCLP Scancell** **

********

Updated charts published on : Carclo, Darktrace Plc, Reabold Resources PLC, Scancell,

LSE:CAR Carclo. Close Mid-Price: 19.5 Percentage Change: + 5.41% Day High: 19 Day Low: 17.55

Continued weakness against CAR taking the price below 17.55 calculates as ……..

</p

View Previous Carclo & Big Picture ***

LSE:DARK Darktrace Plc. Close Mid-Price: 379.2 Percentage Change: + 12.49% Day High: 388 Day Low: 344.9

This is really bad, the definition of a dangerous GaGa movement (circled). ……..

</p

View Previous Darktrace Plc & Big Picture ***

LSE:RBD Reabold Resources PLC. Close Mid-Price: 0.48 Percentage Change: + 16.87% Day High: 0.48 Day Low: 0.44

Continued trades against RBD with a mid-price ABOVE 0.48 should improve t ……..

</p

View Previous Reabold Resources PLC & Big Picture ***

LSE:SCLP Scancell. Close Mid-Price: 11.75 Percentage Change: + 8.05% Day High: 11.75 Day Low: 10.88

Continued weakness against SCLP taking the price below 10.88 calculates a ……..

</p

View Previous Scancell & Big Picture ***