#Brent #Germany We’ve received a few emails regarding Lekoils recent price movements. The AIM used to be notorious for the term “Pump & Dump”, something which mercifully does not happen too often nowadays. However, in the case of Lekoil, their start to the year with a boost to 11p is questionable.

Surprisingly though, the share price had exhibited a glass ceiling at 6.65p with the implication, movement above this level almost had to take the price to 11p. It’s possible the news regarding Quatar at the start of the year started the price moving in a logical uphill path, the target of which almost had to be met before anything else happened. Sometimes, software logic makes little sense – aside from the important detail the share indeed reached 11p, then experienced considerable hesitation.

Finally, the release of news the market perceived as negative has thoroughly stuffed the shares potentials, landing it in a region where our best hope is for a bounce at 0.3p eventually. Of course, there’s a vague chance this “Big Picture” bottom shall remain elusive.

The immediate situation suggests movement above 3.26p should bring recovery to an initial 3.48p. If exceeded, secondary calculates at 4.18p. In fact, unusually, if 4.18p is exceeded, we can give a 3rd target level up at 4.6p. Visually, none of these ambitions give any real hope for the future BUT, if the share were to trade beyond 4.67p, it becomes very possible the drop has been “overcooked” and some genuine recovery should take place.

For the present, we fear the price is now in the hands of “rumour vs reality” price movements but if it were ever to approach 0.3p, we’d hope for a real rebound. Importantly, we cannot calculate below such a level.

|

Time Issued |

Market |

Price At Issue |

Short Entry |

Fast Exit |

Slow Exit |

Stop |

Long Entry |

Fast Exit |

Slow Exit |

Stop |

Prior |

|

9:48:46PM |

BRENT |

64.62 |

63.14 |

62.91 |

62.34 |

64.23 |

64.64 |

64.94 |

65.54 |

64 | |

|

9:50:45PM |

GOLD |

1557.69 | |||||||||

|

9:52:38PM |

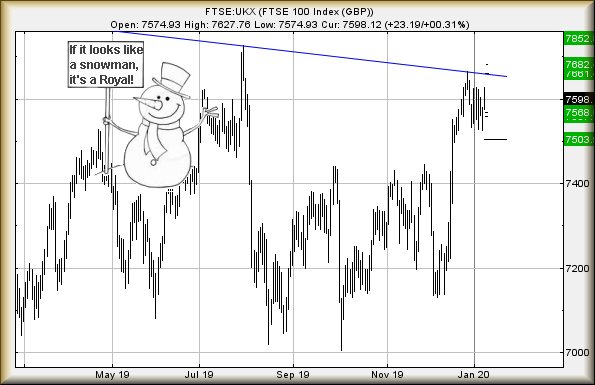

FTSE |

7680.65 |

‘cess | ||||||||

|

9:55:02PM |

FRANCE |

6104.7 |

Success | ||||||||

|

9:57:30PM |

GERMANY |

13524.25 |

13465 |

13440.5 |

13402 |

13536 |

13540 |

13562.5 |

13630 |

13465 |

‘cess |

|

9:59:26PM |

US500 |

3323.62 |

‘cess | ||||||||

|

10:02:17PM |

DOW |

29312.6 |

‘cess | ||||||||

|

10:04:30PM |

NASDAQ |

9160.62 |

Success | ||||||||

|

10:19:45PM |

JAPAN |

24050 |