#Bitcoin #FTSE It has been a strange week, Formula1’s media clickbait staff clearly still on holiday as the press are not slavishly repeating nonsense stories about drivers. This has become one of these “careful what you wish for” moments, surprised at the temptation to click on a headline which suggests Louis Hamilton has employed a media trainer for his dog… The animal was even credited on the closing titles of the Formula1 movie, having made a ‘walk on’ appearance.

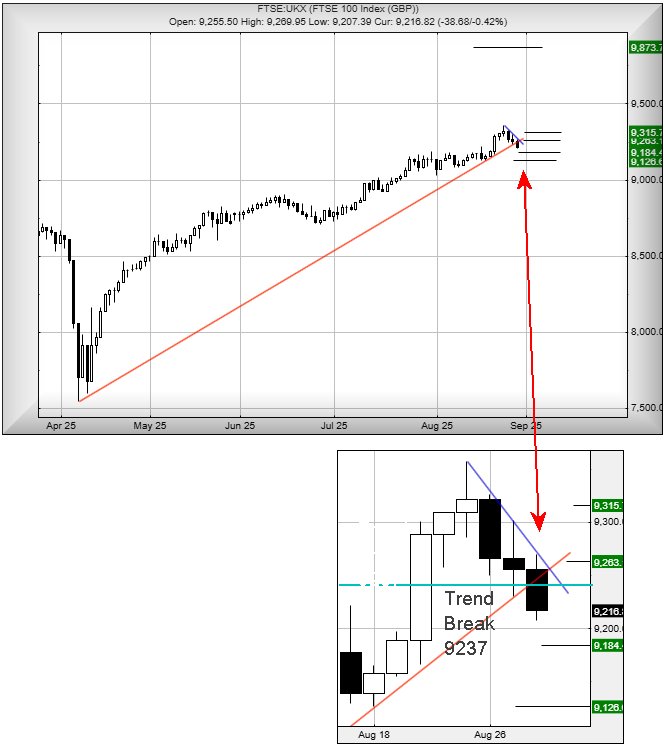

Similarly, the FTSE appears to be avoiding amateur dramatics as August winds its way to a close, aside from our expectation the UK market shall discover an excuse to rewind to the level around which it started the month. Visually, the suggestion is for the need for things to rewind to around 9128.3 points, a drop ambition which feels almost impossible. As Friday is the last trading day of what has been a lacklustre month, it was a surprise to notice the value of the FTSE has managed to enter a potential disaster zone.

Below just 9207 points currently holds the threat of triggering reversal to 9184 points initially with our secondary, if broken, an amazing 9126 points, sufficiently close to the level (9128) at which the month started to justify a drum-role. If this scenario triggers, the tightest stop looks like 9237 points, the trendbreak level providing an amazing stop loss potential for quite a reasonable risk/reward scenario. Even though it’s visually a bit of a free gift and thus dangerous to trust.

Our alternate game plan becomes useful, if the index makes it ABOVE 9237 as this threatens to trigger a gain in the direction of an initial 9263 with our secondary, if bettered, at 9315 points. The attraction with this scenario is it would emplace the index virtually matching the highs of August, while also parking the FTSE value in a zone where a distant 9873 continues to exert an influence further down the line.

It’s absurd, both our Short & Long scenario making their own brand of logic appear sensible, with only a day of the month remaining to satisfy our warped arguments. Unsurprisingly, at time of writing, FTSE Futures are messing around at 9231 points, failing to show a bias in any direction. It is going to be an interesting day.

As for Bitcoin, it is proving as trustworthy as a weather reporter mingling with politicians. There may be a lot of noise but it’s clear none of them are telling the truth!

At present, the value is looking a little dodgy, below 110,250 risking triggering reversal to an initial 106,600 dollars. Our secondary, should such a level break, works out around 100,850 dollars and a return to price levels not seen for 10 weeks. Which isn’t even partially impressive.

We were quite chuffed Bitcoin managed to attain our 120,000 target level, suggested back in June when the value was at 106,000 dollars. The impression given visually is not to be surprised if the value again tries to head up to the 120,000 level with movement above 112,670 but similar to the FTSE attitude given above, we shall not be aghast if this heads back to its prior level around $100k. Any miracle above 120k now calculates with a longer term “risk” of a visit to an astounding $138k.

Have a good weekend, enjoy the chaotic Grand Prix, and remember to tie your wheelie bins down as a breeze is being forecast. But we really distrust weather reporters….

FUTURES

FUTURES

| Time Issued | Market | Price At Issue | Short Entry | Fast Exit | Slow Exit | Stop | Long Entry | Fast Exit | Slow Exit | Stop | Prior |

| 9:59:47PM | BRENT | 6763.1 | 6678 | 6637 | 6581 | 6726 | 6780 | 6818 | 6878 | 6748 | ‘cess |

| 10:03:37PM | GOLD | 3416.33 | 3367 | 3345 | 3319 | 3393 | 3423 | 3429 | 3444 | 3403 | Success |

| 10:34:02PM | FTSE | 9222.8 | 9206 | 9181 | 9121 | 9237 | 9273 | 9295 | 9325 | 9238 | ‘cess |

| 10:36:03PM | STOX50 | 5397.4 | 5373 | 5344 | 5289 | 5406 | 5429 | 5454 | 5484 | 5387 | ‘cess |

| 10:39:29PM | GERMANY | 24040.5 | 23970 | 23947 | 23750 | 24084 | 24204 | 24243 | 24284 | 24022 | ‘cess |

| 10:41:49PM | US500 | 6502.2 | 6466 | 6451 | 6432 | 6494 | 6508 | 6524 | 6584 | 6466 | ‘cess |

| 10:47:29PM | DOW | 45596.4 | 45435 | 45341 | 45227 | 45560 | 45686 | 45797 | 46027 | 45545 | ‘cess |

| 10:50:14PM | NASDAQ | 23699.4 | 23513 | 23446 | 23347 | 23624 | 23708 | 23748 | 23872 | 23516 | ‘cess |

| 10:53:13PM | JAPAN | 42900 | 42712 | 42620 | 42483 | 42846 | 43028 | 43146 | 43484 | 42856 | Success |

28/08/2025 FTSE Closed at 9216 points. Change of -0.42%. Total value traded through LSE was: £ 4,470,443,849 a change of -4.77%

27/08/2025 FTSE Closed at 9255 points. Change of -0.11%. Total value traded through LSE was: £ 4,694,536,884 a change of -52.24%

26/08/2025 FTSE Closed at 9265 points. Change of -0.6%. Total value traded through LSE was: £ 9,830,321,527 a change of 125.64%

22/08/2025 FTSE Closed at 9321 points. Change of 0.13%. Total value traded through LSE was: £ 4,356,702,954 a change of 17.66%

21/08/2025 FTSE Closed at 9309 points. Change of 0.23%. Total value traded through LSE was: £ 3,702,661,970 a change of -40.14%

20/08/2025 FTSE Closed at 9288 points. Change of 1.08%. Total value traded through LSE was: £ 6,185,994,315 a change of -5.2%

19/08/2025 FTSE Closed at 9189 points. Change of -100%. Total value traded through LSE was: £ 6,525,328,498 a change of 0%

SUCCESS above means both FAST & SLOW targets were met. ‘CESS means just the FAST target met and probably the next time it is exceeded, movement to the SLOW target shall commence.

Our commentary is in two sections. Immediately below are today’s updated comments. If our commentary remains valid, the share can be found in the bottom section which has a RED heading. Hopefully, this will mean you no longer need to flip back through previous reports. HYPERLINKS DISABLED IN THIS VERSION

Please remember, all prices are mid-price (halfway between the Buy and Sell). When we refer to a price CLOSING above a specific level, we are viewing the point where we can regard a trend as changing. Otherwise, we are simply speculating on near term trading targets. Our website is www.trendsandtargets.com.

UPDATE. We often give an initial and a secondary price. If the initial is exceeded, we still expect it to fall back but the next time the initial is bettered, the price should continue to the secondary. The converse it true with price drops.

We can be contacted at info@trendsandtargets.com. Spam filters set to maximum so only legit emails get through…

Section One – Outlook Updated Today. Click here for Section Two – Outlook Remains Valid shares

Click Epic to jump to share: LSE:CCL Carnival** **LSE:FRES Fresnillo** **LSE:IGG IG Group** **LSE:TW. Taylor Wimpey** **

********

Updated charts published on : Carnival, Fresnillo, IG Group, Taylor Wimpey,

LSE:CCL Carnival. Close Mid-Price: 2185 Percentage Change: + 0.60% Day High: 2206 Day Low: 2173

Target met. Continued trades against CCL with a mid-price ABOVE 2206 shou ……..

</p

View Previous Carnival & Big Picture ***

LSE:FRES Fresnillo Close Mid-Price: 1753 Percentage Change: -0.23% Day High: 1779 Day Low: 1739

Continued trades against FRES with a mid-price ABOVE 1779 should improve ……..

</p

View Previous Fresnillo & Big Picture ***

LSE:IGG IG Group Close Mid-Price: 1138 Percentage Change: -1.13% Day High: 1158 Day Low: 1132

In the event of IG Group enjoying further trades beyond 1158, the share s ……..

</p

View Previous IG Group & Big Picture ***

LSE:TW. Taylor Wimpey Close Mid-Price: 97.3 Percentage Change: -1.40% Day High: 99.24 Day Low: 97.16

Weakness on Taylor Wimpey below 97.16 will invariably lead to 89p with se ……..

</p

View Previous Taylor Wimpey & Big Picture ***