#FTSE #GOLD

The weather forecast, here in Argyll, Scotland, suggests a low of 8c and potential high of 19c for Friday. And rain too. Apparently the sun is shining everywhere else though, except upon stock markets, the FTSE now rigidly falling into line with other world markets, following the herd. It’s becoming clear we’re now in full holiday season mode. Even Google News, our internet home page, has stopped leading with invented stories from the media about Russia/Ukraine. Instead they’ve embraced “silly season” and focus on invented stories about the war closer to home, the battle to become the next UK Prime Minister.

In fact, there were only two Russia/Ukraine stories visible this evening and one of them, a so called “fact check”, revealed a video of an army convoy exploding was computer generated from a video game.

The point behind our opening paragraph is straightforward. At this time of year, it becomes dangerous to rely on common sense in predicting market direction. There’s currently a heck of a strong argument favouring the last week of July being pretty vile, due to a tranche of economic announcements from the USA which are expected to be viewed negatively. In addition, there are a bunch of US company Earnings Reports, also expected to be poor and capable of provoking severe market reversals.

Will this prove to be the case? We’re not convinced.

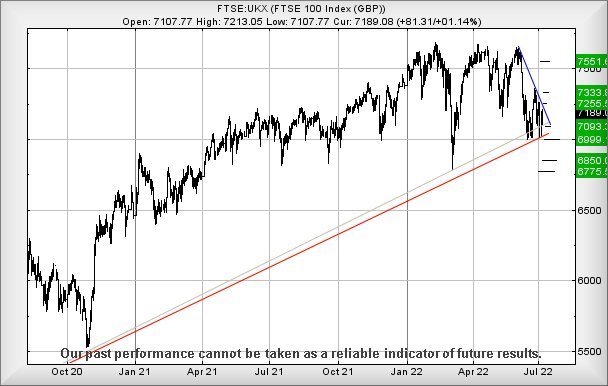

It’s certainly still the case we suspect the FTSE shall discover sufficient excuse to head to the 6,800 point level but something quite odd occurred on Thursday. In our morning Futures update, we alerted clients of our expectation the markets would bounce properly at our secondary drop targets. But, aside from Germany and the Stoxx50, other markets bounced just above our secondary targets. Germany opted be break the secondary quite substantially before bouncing, as did the Stoxx. Usually, our thinking allows a break of a secondary to imply further market weakness shall make itself known but the only thing Thursday managed successfully was to send a raft of contrary signals. (The FTSE bounced 9 points ABOVE our secondary, suggesting strength).

We’re trying to convey a lack of confidence about overall market directions for Friday! The FTSE closed the session at 7039 points, down 1.6%.

For the FTSE, now below 6996 points looks troubling, calculating with the potential of ongoing reversals to an initial 6967 points. If broken our secondary now looks problematic, working out at a ridiculous looking 6748 points. If the drop triggers, the tightest stop loss level looks like 7052 points. However, there’s a strong short term argument favouring a bounce at 6967, if it makes an appearance.

Our alternate scenario, favouring FTSE gains, suggests FTSE strength bettering 7078 points has the potential of a lift to 7115 points. If bettered, our secondary calculates as (so impressive it’s unlikely) 7233 points. Who knows, maybe the sun shall once again shine on the FTSE.

Have a good weekend, sadly one ruined by the lack of a Formula 1 race.

Finally, the photo below brought a smile. A couple on holiday in their 50′ yacht, decided to drop anchor outside, saving themselves the cost of an overnight berth in the local marina. Somehow or other, they forgot about the tide, providing an unusual sight of such a large vessel ‘high and dry’. The beach, thankfully, is pebble and it refloated a few hours later, the boat now a star on Twitter.

FUTURES

| Time Issued | Market | Price At Issue | Short Entry | Fast Exit | Slow Exit | Stop | Long Entry | Fast Exit | Slow Exit | Stop | Prior |

| 9:15:45PM | BRENT | 97.82 | 95.15 | 92.99 | 97.15 | 98.67 | 99.47 | 95.23 | Success | ||

| 9:17:31PM | GOLD | 1710 | 1697 | 1694 | 1714 | 1717 | 1723 | 1703 | |||

| 9:21:04PM | FTSE | 7079 | 7003 | 6900 | 7040 | 7084 | 7095 | 7050 | Success | ||

| 9:33:29PM | STOX50 | 3428 | 3368 | 3357 | 3403 | 3429 | 3436 | 3412 | ‘cess | ||

| 9:35:58PM | GERMANY | 12598 | 12523 | 12465 | 12614 | 12612 | 12649 | 12524 | ‘cess | ||

| 9:39:20PM | US500 | 3792 | 3739 | 3682 | 3754 | 3796 | 3807 | 3774 | ‘cess | ||

| 9:42:21PM | DOW | 30653 | 30131 | 29738 | 30471 | 30688 | 30704 | 30505 | Success | ||

| 9:50:03PM | NASDAQ | 11782 | 11481 | 11025.5 | 11653 | 11805 | 11859 | 11710 | Success | ||

| 9:53:01PM | JAPAN | 26707 | 26422 | 26382 | 26560 | 26774 | 26847 | 26619 | Success |

14/07/2022 FTSE Closed at 7039 points. Change of -1.63%. Total value traded through LSE was: £ 5,842,341,415 a change of 1.71%

13/07/2022 FTSE Closed at 7156 points. Change of -0.74%. Total value traded through LSE was: £ 5,744,207,139 a change of 25.49%

12/07/2022 FTSE Closed at 7209 points. Change of 0.18%. Total value traded through LSE was: £ 4,577,434,257 a change of 19.25%

11/07/2022 FTSE Closed at 7196 points. Change of 0%. Total value traded through LSE was: £ 3,838,648,394 a change of -17.76%

8/07/2022 FTSE Closed at 7196 points. Change of 0.1%. Total value traded through LSE was: £ 4,667,898,504 a change of -40.47%

7/07/2022 FTSE Closed at 7189 points. Change of 1.15%. Total value traded through LSE was: £ 7,840,836,272 a change of 27.41%

6/07/2022 FTSE Closed at 7107 points. Change of 1.17%. Total value traded through LSE was: £ 6,153,962,952 a change of -14.34%

SUCCESS above means both FAST & SLOW targets were met. ‘CESS means just the FAST target met and probably the next time it is exceeded, movement to the SLOW target shall commence.

Our commentary is in two sections. Immediately below are today’s updated comments. If our commentary remains valid, the share can be found in the bottom section which has a RED heading. Hopefully, this will mean you no longer need to flip back through previous reports. HYPERLINKS DISABLED IN THIS VERSION

Please remember, all prices are mid-price (halfway between the Buy and Sell). When we refer to a price CLOSING above a specific level, we are viewing the point where we can regard a trend as changing. Otherwise, we are simply speculating on near term trading targets. Our website is www.trendsandtargets.com.

UPDATE. We often give an initial and a secondary price. If the initial is exceeded, we still expect it to fall back but the next time the initial is bettered, the price should continue to the secondary. The converse it true with price drops.

We can be contacted at info@trendsandtargets.com. Spam filters set to maximum so only legit emails get through…

Section One – Outlook Updated Today. Click here for Section Two – Outlook Remains Valid shares

Click Epic to jump to share: LSE:AML Aston Martin** **LSE:BP. BP PLC** **LSE:CBX Cellular Goods** **LSE:CNA Centrica** **LSE:GENL Genel** **LSE:GKP Gulf Keystone** **LSE:GLEN Glencore Xstra** **LSE:LLOY Lloyds Grp.** **LSE:MKS Marks and Spencer** **LSE:RKH Rockhopper** **LSE:STAN Standard Chartered** **

********

Updated charts published on : Aston Martin, BP PLC, Cellular Goods, Centrica, Genel, Gulf Keystone, Glencore Xstra, Lloyds Grp., Marks and Spencer, Rockhopper, Standard Chartered,

LSE:AML Aston Martin Close Mid-Price: 371.3 Percentage Change: -7.68% Day High: 425.7 Day Low: 366.4

Weakness on Aston Martin below 366.4 will invariably lead to 363 with se ……..

</p

View Previous Aston Martin & Big Picture ***

LSE:BP. BP PLC Close Mid-Price: 363.95 Percentage Change: -3.51% Day High: 380.4 Day Low: 359.2

Continued weakness against BP. taking the price below 359.2 calculates as ……..

</p

View Previous BP PLC & Big Picture ***

LSE:CBX Cellular Goods. Close Mid-Price: 1.3 Percentage Change: + 6.12% Day High: 1.3 Day Low: 1.23

Continued trades against CBX with a mid-price ABOVE 1.3 should improve th ……..

</p

View Previous Cellular Goods & Big Picture ***

LSE:CNA Centrica. Close Mid-Price: 85.58 Percentage Change: + 1.45% Day High: 87.7 Day Low: 84.88

Continued trades against CNA with a mid-price ABOVE 87.7 should improve t ……..

</p

View Previous Centrica & Big Picture ***

LSE:GENL Genel Close Mid-Price: 123.2 Percentage Change: -0.16% Day High: 124 Day Low: 120.4

Weakness on Genel below 120.4 will invariably lead to 100 next with secon ……..

</p

View Previous Genel & Big Picture ***

LSE:GKP Gulf Keystone Close Mid-Price: 200.5 Percentage Change: -15.40% Day High: 222.5 Day Low: 201

Target met. If Gulf Keystone experiences continued weakness below 201, it ……..

</p

View Previous Gulf Keystone & Big Picture ***

LSE:GLEN Glencore Xstra Close Mid-Price: 401.3 Percentage Change: -4.10% Day High: 420.85 Day Low: 397.25

In the event Glencore Xstra experiences weakness below 397.25 it calculat ……..

</p

View Previous Glencore Xstra & Big Picture ***

LSE:LLOY Lloyds Grp. Close Mid-Price: 41.02 Percentage Change: -2.14% Day High: 42.15 Day Low: 40.97

Continued weakness against LLOY taking the price below 40.97 calculates a ……..

</p

View Previous Lloyds Grp. & Big Picture ***

LSE:MKS Marks and Spencer Close Mid-Price: 129.5 Percentage Change: -2.08% Day High: 133.9 Day Low: 127.2

Weakness on Marks and Spencer below 127.2 will invariably lead to 98 with ……..

</p

View Previous Marks and Spencer & Big Picture ***

LSE:RKH Rockhopper Close Mid-Price: 6.74 Percentage Change: -4.26% Day High: 6.64 Day Low: 6.5

Weakness on Rockhopper below 6.5 will invariably lead to 6p with secondar ……..

</p

View Previous Rockhopper & Big Picture ***

LSE:STAN Standard Chartered Close Mid-Price: 544 Percentage Change: -5.72% Day High: 576.6 Day Low: 543.2

Weakness on Standard Chartered below 543.2 will invariably lead to 511 wi ……..

</p

View Previous Standard Chartered & Big Picture ***