#FTSE #Gold

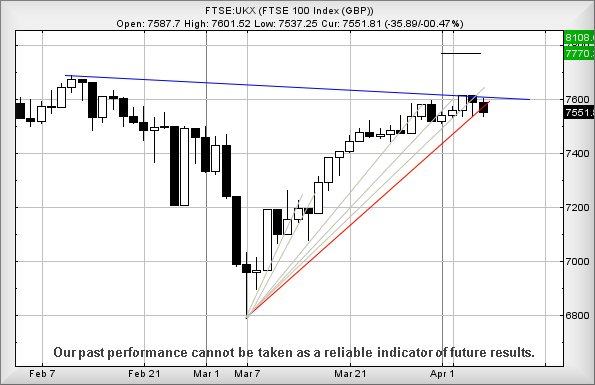

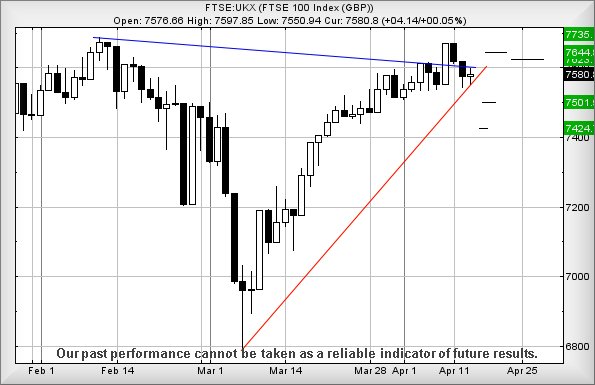

Some slight hope is apparent the FTSE should finally do something positive. Then again, it’s maybe just everyone looking forward to the chocolate jamboree over the coming Easter weekend, along with the first real stock market holiday of 2022. So far, April has proven quite frustrating, plenty of little nudges in the right direction, all invariably failing to come to fruition thanks to marketplace nerves about Russia, Johnston, inflation, the Chancellor, interest rates, parties, Covid-19, and anything else which takes the media’s fancy.

Meanwhile, there’s some concern among some sections of the media over reports the largest comet ever recorded is heading toward our planet and intends give it a miss… A bit of a pity as any excuse is always welcome to avoid trimming the lawn edges.

The FTSE closed Wednesday at 7580 points and now, need only exceed 7600 to enter a cycle toward an initial 7623 points. If bettered, our secondary ambition comes along at 7644 points and there’s something extremely interesting at such a level. Essentially, above 7644 and there’s very little impediment toward the FTSE entering a sharp race uphill toward 7735 points!

Should things decide to go the other way, our reversal scenario is fairly straightforward. Weakness now below 7550 points looks capable of promoting reversal to an initial 7501 points with secondary, if broken, down at 7424 points.

For the present, we’re inclined toward FTSE optimism, though perhaps it’s the threat of enjoying a couple of days break which, against all rules, look certain to be accompanied by good weather. Have a good weekend.

FUTURES

| Time Issued | Market | Price At Issue | Short Entry | Fast Exit | Slow Exit | Stop | Long Entry | Fast Exit | Slow Exit | Stop | Prior |

| 9:43:22PM | BRENT | 108.34 | 103.81 | 102.735 | 105.3 | 108.63 | 109.3 | 106.75 | Success | ||

| 9:44:46PM | GOLD | 1976.79 | 1962 | 1957 | 1973 | 1982 | 1984 | 1971 | |||

| 9:47:15PM | FTSE | 7572.78 | 7541 | 7532 | 7581 | 7596 | 7623 | 7555 | |||

| 9:49:36PM | FRANCE | 6543.7 | 6462 | 6425 | 6528 | 6568 | 6605 | 6474 | ‘cess | ||

| 9:51:45PM | GERMANY | 14092 | 13958 | 13936 | 14057 | 14142 | 14165 | 14065 | |||

| 10:07:22PM | US500 | 4444 | 4388 | 4368 | 4406 | 4448 | 4458 | 4436 | |||

| 10:16:57PM | DOW | 34556.9 | 34142 | 34027 | 34302 | 34608 | 34622 | 34523 | ‘cess | ||

| 10:19:49PM | NASDAQ | 14206.24 | 14120 | 14064 | 14182 | 14263 | 14318 | 14164 | Success | ||

| 10:22:20PM | JAPAN | 26916 | 26645 | 26608 | 26804 | 26975 | 27051 | 26817 | ‘cess |

13/04/2022 FTSE Closed at 7580 points. Change of 0.05%. Total value traded through LSE was: £ 5,507,163,189 a change of -5.24%

12/04/2022 FTSE Closed at 7576 points. Change of -0.55%. Total value traded through LSE was: £ 5,811,485,837 a change of 3.97%

11/04/2022 FTSE Closed at 7618 points. Change of -0.67%. Total value traded through LSE was: £ 5,589,702,864 a change of 0.53%

8/04/2022 FTSE Closed at 7669 points. Change of 1.56%. Total value traded through LSE was: £ 5,560,387,967 a change of -14.51%

7/04/2022 FTSE Closed at 7551 points. Change of -0.47%. Total value traded through LSE was: £ 6,503,801,029 a change of -11.79%

6/04/2022 FTSE Closed at 7587 points. Change of -0.34%. Total value traded through LSE was: £ 7,373,306,998 a change of -8.37%

5/04/2022 FTSE Closed at 7613 points. Change of 0.73%. Total value traded through LSE was: £ 8,046,795,473 a change of 61.76%

SUCCESS above means both FAST & SLOW targets were met. ‘CESS means just the FAST target met and probably the next time it is exceeded, movement to the SLOW target shall commence.

Our commentary is in two sections. Immediately below are today’s updated comments. If our commentary remains valid, the share can be found in the bottom section which has a RED heading. Hopefully, this will mean you no longer need to flip back through previous reports. HYPERLINKS DISABLED IN THIS VERSION

Please remember, all prices are mid-price (halfway between the Buy and Sell). When we refer to a price CLOSING above a specific level, we are viewing the point where we can regard a trend as changing. Otherwise, we are simply speculating on near term trading targets. Our website is www.trendsandtargets.com.

UPDATE. We often give an initial and a secondary price. If the initial is exceeded, we still expect it to fall back but the next time the initial is bettered, the price should continue to the secondary. The converse it true with price drops.

We can be contacted at info@trendsandtargets.com. Spam filters set to maximum so only legit emails get through…

Section One – Outlook Updated Today. Click here for Section Two – Outlook Remains Valid shares

Click Epic to jump to share: LSE:AGM Applied Graphene** **LSE:AML Aston Martin** **LSE:BDEV Barrett Devs** **LSE:BP. BP PLC** **LSE:CASP Caspian** **LSE:DARK Darktrace Plc** **LSE:EXPN Experian** **LSE:FRES Fresnillo** **LSE:GENL Genel** **LSE:ITRK Intertek** **LSE:JET Just Eat** **LSE:SBRY Sainsbury** **LSE:SRP Serco** **LSE:TSCO Tesco** **

********

Updated charts published on : Applied Graphene, Aston Martin, Barrett Devs, BP PLC, Caspian, Darktrace Plc, Experian, Fresnillo, Genel, Intertek, Just Eat, Sainsbury, Serco, Tesco,

LSE:AGM Applied Graphene. Close Mid-Price: 19 Percentage Change: + 0.00% Day High: 19 Day Low: 19

In the event Applied Graphene experiences weakness below 19, it calculates ……..

</p

View Previous Applied Graphene & Big Picture ***

LSE:AML Aston Martin Close Mid-Price: 807 Percentage Change: -1.25% Day High: 823.4 Day Low: 783

Target Met. Now below 782 suggests reversal to 765 next with secondary, if ……..

</p

View Previous Aston Martin & Big Picture ***

LSE:BDEV Barrett Devs Close Mid-Price: 502.6 Percentage Change: -1.99% Day High: 515.4 Day Low: 499.6

In the event Barrett Devs experiences weakness below 499.6 it calculates ……..

</p

View Previous Barrett Devs & Big Picture ***

LSE:BP. BP PLC. Close Mid-Price: 397.35 Percentage Change: + 0.35% Day High: 400.7 Day Low: 392.8

Further movement against BP PLC ABOVE 400.7 should improve acceleration t ……..

</p

View Previous BP PLC & Big Picture ***

LSE:CASP Caspian Close Mid-Price: 2.9 Percentage Change: -3.33% Day High: 3 Day Low: 2.8

Continued weakness against CASP taking the price below 2.8 calculates as ……..

</p

View Previous Caspian & Big Picture ***

LSE:DARK Darktrace Plc Close Mid-Price: 399.8 Percentage Change: -11.65% Day High: 479 Day Low: 384.7

In the event Darktrace Plc experiences weakness below 384.7 it calculates ……..

</p

View Previous Darktrace Plc & Big Picture ***

LSE:EXPN Experian Close Mid-Price: 2734 Percentage Change: -0.69% Day High: 2744 Day Low: 2693

If Experian experiences continued weakness below 2693, it will invariably ……..

</p

View Previous Experian & Big Picture ***

LSE:FRES Fresnillo. Close Mid-Price: 822.8 Percentage Change: + 2.88% Day High: 822.8 Day Low: 793.4

Further movement against Fresnillo ABOVE 822.8 should improve acceleratio ……..

</p

View Previous Fresnillo & Big Picture ***

LSE:GENL Genel Close Mid-Price: 194 Percentage Change: -1.02% Day High: 199 Day Low: 194.2

In the event of Genel enjoying further trades beyond 199, the share shoul ……..

</p

View Previous Genel & Big Picture ***

LSE:ITRK Intertek Close Mid-Price: 5060 Percentage Change: -0.43% Day High: 5082 Day Low: 5006

Continued weakness against ITRK taking the price below 5006 calculates as ……..

</p

View Previous Intertek & Big Picture ***

LSE:JET Just Eat Close Mid-Price: 2389.5 Percentage Change: -4.52% Day High: 2503.5 Day Low: 2325.5

If Just Eat experiences continued weakness below 2325.5, it will invariab ……..

</p

View Previous Just Eat & Big Picture ***

LSE:SBRY Sainsbury Close Mid-Price: 238.6 Percentage Change: -2.45% Day High: 242.1 Day Low: 234.8

Weakness on Sainsbury below 234.8 will invariably lead to 220 with second ……..

</p

View Previous Sainsbury & Big Picture ***

LSE:SRP Serco. Close Mid-Price: 150 Percentage Change: + 1.28% Day High: 152.1 Day Low: 147.7

Target met. Further movement against Serco ABOVE 152.1 should improve acc ……..

</p

View Previous Serco & Big Picture ***

LSE:TSCO Tesco Close Mid-Price: 265.2 Percentage Change: -2.00% Day High: 264.6 Day Low: 251.7

Target met. In the event Tesco experiences weakness below 251.7 it calcul ……..

</p

View Previous Tesco & Big Picture ***