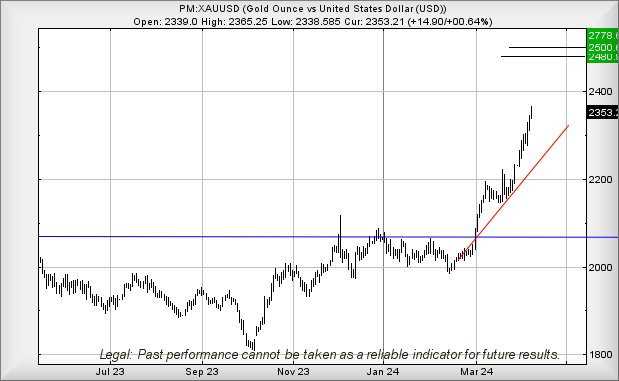

#Gold #Centamin Obviously, with the price of Gold currently behaving as if it’s on steroids, we’ve been receiving a bunch of emails asking about various Gold mining shares. Amusingly, with Gold currently around $2350, our report on Gold in November last year issued a future target of $2357, being careful to admit this target would probably prove similar to the ambition of politicians to ship illegal immigrants off to Rwanda, something promised but never attained.

However, movements on the price of Gold since the start of March have proven our cautious nature was a load of tosh and once the price of the metal successfully closed above the glass ceiling (Blue on the chart), it was only to be a matter of time until it sprouted faster than a dandelion on a sunny day. Gold is now showing some useful potentials, needing below 2080 to spoil the party. Instead, it now appears likely above $2357 provides the potential of a lift to an initial 2480 with secondary, if bettered, at $2500 and some potential hesitation, if only to satisfy all the doom-sayers who will claim it can’t surpass this level. In normal circumstances, we’d agree except for two things.

Firstly, a bunch of folk will almost certainly open Short positions at the $2500 and there are few things the market finds funnier than collecting a bunch of stop losses.

Secondly, perhaps more importantly, the Big Picture now claims a future $2778 is possible for Gold, a price level where unless “they” start gapping it up, the metal should almost certainly experience some collywobbles.

Centamin Plc, the Gold producer active in Egypt and further down around the Ivory Coast, show extraction results which would shame the “best” commercial producers on Discovery’s Gold Rush TV show. For instance, in 2023, they extracted nearly 1/2 million ounces from their Sukari pit, a number which compares favourably against the best producer on the TV show who extracted nearly 8,000 ounces in the Yukon. Though, if we break it down to “Ounces Per Employee”, the guys in the Yukon appear to be far more efficient!

Our immediate outlook for Centamin suggests above 125 should prove capable of boosting the share price to a less than impressive 127.6p. Our secondary, above such a level, calculates at a future 144p, along with a demand the share price close above such a level to hopefully make a Big Picture future 177p a reality. The share price certainly has fairly strong prospect and we cannot help but wonder when the runaway price of Gold may spread into high revenue expectations for miners.

If things intend go wrong for LSE:CEY, the share price needs drop below 106p to spark trouble, allowing reversal to an initial 100 with secondary, if broken, at a probable bottom of 91p.

FUTURES

| Time Issued | Market | Price At Issue | Short Entry | Fast Exit | Slow Exit | Stop | Long Entry | Fast Exit | Slow Exit | Stop | Prior |

| 9:56:30PM | BRENT | 8911.9 | |||||||||

| 9:58:48PM | GOLD | 2352.65 | Success | ||||||||

| 11:23:52PM | FTSE | 7945 | 7917 | 7903 | 7880 | 7947 | 7971 | 7986 | 8004 | 7929 | ‘cess |

| 11:53:18PM | STOX50 | 5006.4 | 4981 | 4962 | 4909 | 5028 | 5042 | 5062 | 5089 | 5006 | ‘cess |

| 12:02:59AM | GERMANY | 18125 | ‘cess | ||||||||

| 12:04:59AM | US500 | 5214.8 | ‘cess | ||||||||

| 12:23:15AM | DOW | 38915 | Success | ||||||||

| 12:28:39AM | NASDAQ | 18183 | |||||||||

| 12:31:07AM | JAPAN | 39639 | ‘cess |

9/04/2024 FTSE Closed at 7934 points. Change of -0.11%. Total value traded through LSE was: £ 6,567,332,567 a change of 22.56%

8/04/2024 FTSE Closed at 7943 points. Change of 0.4%. Total value traded through LSE was: £ 5,358,628,061 a change of -25.26%

5/04/2024 FTSE Closed at 7911 points. Change of -0.8%. Total value traded through LSE was: £ 7,169,871,265 a change of 23.49%

4/04/2024 FTSE Closed at 7975 points. Change of 0.48%. Total value traded through LSE was: £ 5,806,012,925 a change of -4.14%

3/04/2024 FTSE Closed at 7937 points. Change of 0.03%. Total value traded through LSE was: £ 6,056,901,297 a change of -5.31%

2/04/2024 FTSE Closed at 7935 points. Change of -100%. Total value traded through LSE was: £ 6,396,592,284 a change of 0%

28/03/2024 FTSE Closed at 7952 points. Change of 0%. Total value traded through LSE was: £ 5,611,823,607 a change of 0%

SUCCESS above means both FAST & SLOW targets were met. ‘CESS means just the FAST target met and probably the next time it is exceeded, movement to the SLOW target shall commence.

Our commentary is in two sections. Immediately below are today’s updated comments. If our commentary remains valid, the share can be found in the bottom section which has a RED heading. Hopefully, this will mean you no longer need to flip back through previous reports. HYPERLINKS DISABLED IN THIS VERSION

Please remember, all prices are mid-price (halfway between the Buy and Sell). When we refer to a price CLOSING above a specific level, we are viewing the point where we can regard a trend as changing. Otherwise, we are simply speculating on near term trading targets. Our website is www.trendsandtargets.com.

UPDATE. We often give an initial and a secondary price. If the initial is exceeded, we still expect it to fall back but the next time the initial is bettered, the price should continue to the secondary. The converse it true with price drops.

We can be contacted at info@trendsandtargets.com. Spam filters set to maximum so only legit emails get through…

Section One – Outlook Updated Today. Click here for Section Two – Outlook Remains Valid shares

Click Epic to jump to share: LSE:AAL Anglo American** **LSE:AFC AFC Energy** **LSE:BP. BP PLC** **LSE:CAR Carclo** **LSE:CEY Centamin** **LSE:GKP Gulf Keystone** **LSE:HSBA HSBC** **LSE:OCDO Ocado Plc** **LSE:SCLP Scancell** **LSE:TERN Tern Plc** **LSE:TLW Tullow** **

********

Updated charts published on : Anglo American, AFC Energy, BP PLC, Carclo, Centamin, Gulf Keystone, HSBC, Ocado Plc, Scancell, Tern Plc, Tullow,

LSE:AAL Anglo American. Close Mid-Price: 2191.5 Percentage Change: + 1.69% Day High: 2212 Day Low: 2159

Target met. In the event of Anglo American enjoying further trades beyond ……..

</p

View Previous Anglo American & Big Picture ***

LSE:AFC AFC Energy. Close Mid-Price: 19.14 Percentage Change: + 2.46% Day High: 19.24 Day Low: 18.5

Continued trades against AFC with a mid-price ABOVE 19.24 should improve ……..

</p

View Previous AFC Energy & Big Picture ***

LSE:BP. BP PLC. Close Mid-Price: 516.6 Percentage Change: + 1.31% Day High: 520.3 Day Low: 513.6

Further movement against BP PLC ABOVE 520.3 should improve acceleration t ……..

</p

View Previous BP PLC & Big Picture ***

LSE:CAR Carclo Close Mid-Price: 7.25 Percentage Change: -3.33% Day High: 6.95 Day Low: 6.95

Continued weakness against CAR taking the price below 6.95 calculates as ……..

</p

View Previous Carclo & Big Picture ***

LSE:CEY Centamin. Close Mid-Price: 124.5 Percentage Change: + 2.81% Day High: 124.8 Day Low: 122

Target met. Further movement against Centamin ABOVE 124.8 should improve ……..

</p

View Previous Centamin & Big Picture ***

LSE:GKP Gulf Keystone. Close Mid-Price: 123 Percentage Change: + 3.36% Day High: 127.8 Day Low: 118

In the event of Gulf Keystone enjoying further trades beyond 127.8, the s ……..

</p

View Previous Gulf Keystone & Big Picture ***

LSE:HSBA HSBC. Close Mid-Price: 644.7 Percentage Change: + 0.03% Day High: 649.2 Day Low: 643.1

Target met. Continued trades against HSBA with a mid-price ABOVE 649.2 sh ……..

</p

View Previous HSBC & Big Picture ***

LSE:OCDO Ocado Plc. Close Mid-Price: 380.6 Percentage Change: + 1.47% Day High: 391.4 Day Low: 362.8

Target met. Continued weakness against OCDO taking the price below 362.8 ……..

</p

View Previous Ocado Plc & Big Picture ***

LSE:SCLP Scancell Close Mid-Price: 9.85 Percentage Change: -3.90% Day High: 10.25 Day Low: 9.65

In the event Scancell experiences weakness below 9.65 it calculates with ……..

</p

View Previous Scancell & Big Picture ***

LSE:TERN Tern Plc. Close Mid-Price: 3.6 Percentage Change: + 16.13% Day High: 3.85 Day Low: 3.1

Target met. Further movement against Tern Plc ABOVE 3.85 should improve a ……..

</p

View Previous Tern Plc & Big Picture ***

LSE:TLW Tullow. Close Mid-Price: 35.02 Percentage Change: + 2.58% Day High: 35.34 Day Low: 34.2

Continued trades against TLW with a mid-price ABOVE 35.34 should improve ……..

</p

View Previous Tullow & Big Picture ***