#DOW #Brent #SP500 There’s something unsettling about the 5th largest economy in the world (the UK!) needing the NHS aided with crowdfunding, as we try to cope with the effects of Covid-19. It’s about as disturbing as one of these “xyz Relief” charity events, fronted by entertainment/sports millionaires (who’re being paid for their presence) in usually successful efforts to part the gullible from their money. It’s easy to conclude the public are seen as a soft touch, unthinking in their wish to hope they are doing the right thing.

This period of self-isolation continues to provide ample opportunity to over-think everything as the foregoing proves. Some light relief came when burning the contents of the “recycling” bin. Apparently our local council is far from unusual in suspending collections, a glance at the overflowing bin revealing it’s mostly full of flammable items. Thus, the area designated as the burning pit for debris from the trees in the garden was retasked, giving pause for thought when an overlooked plastic bottle of white spirit dregs ignited quite energetically. Judging by occasional black smoke clouds around the loch, it looks like we’re not the only folk finding a new source of entertainment.

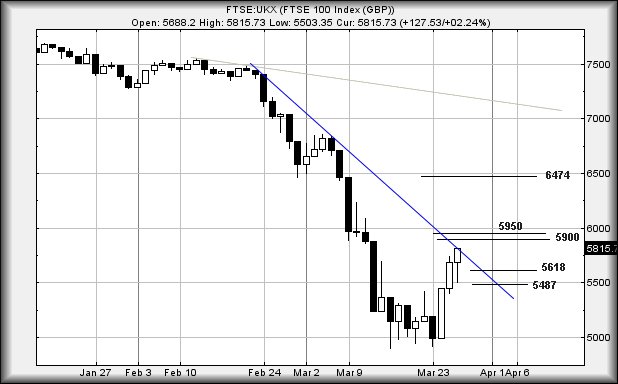

Other residents in the Land of Gullible risk being market traders. We’ve reported our conclusion the markets risk being trapped for a while, stuffed into a trading range while we await the next major push (it could be up, it could be down). Monday proved such a day, the FTSE swinging from nearly 2% down to end the session nearly 1% up. Visually, there’s a risk the market intends to be trapped between 5,350 and 5,800 points or so.

At present, if the FTSE somehow manages above 5,935 points, there’s a pretty strong chance the rise shall prove genuine. A movement such as this risks triggering a further 500 point surge upward. Early warning for a miracle looks like movement now above 5,822 points.

Equally, below 5,470 risks providing early warning for a reversal toward 5,260 points. Confirmation shall be regarded as coming if the index wanders below 5,350 points.

As for Wall St, it has parked itself for the last 3 sessions, trapped in a useful 1,100 point range between 21,400 and 22,500 points or so.

Movement now above 22,380 is supposed to be capable of a lift to an initial 22,492 which is believable. If exceeded, secondary calculates at a more dubious 22,845 points. While writing this, news of a US Navy hospital ship docking in New York harbour has appeared, a distance just 8 miles from Wall St.

The alternate, and more likely, scenario is of weakness now below 21,830 taking Wall St down to 21,486 points. If broken, secondary calculates at 21,260 points. This is dangerous (and risks breaking the “parked” theory, driving the US index into a region where it could swiftly lose a further 700 points.

We live in interesting times.

FUTURES

| Time Issued |

Market |

Price At Issue |

Short Entry |

Fast Exit |

Slow Exit |

Stop |

Long Entry |

Fast Exit |

Slow Exit |

Stop |

Prior |

| 10:37:13PM |

BRENT |

26.36 |

25.02 |

23.48 |

20.59 |

26.75 |

26.95 |

27.51 |

28.27 |

25.27 |

Success |

| 10:45:03PM |

GOLD |

1625.19 |

|

|

|

|

|

|

|

|

|

| 10:47:51PM |

FTSE |

5583.22 |

|

|

|

|

|

|

|

|

‘cess |

| 10:50:05PM |

FRANCE |

4397 |

|

|

|

|

|

|

|

|

|

| 10:56:52PM |

GERMANY |

9875 |

|

|

|

|

|

|

|

|

‘cess |

| 10:59:20PM |

US500 |

2627.04 |

2505 |

2484.5 |

2435 |

2550 |

2634 |

2654 |

2688 |

2585 |

Shambles |

| 11:02:01PM |

DOW |

22363 |

|

|

|

|

|

|

|

|

|

| 11:05:05PM |

NASDAQ |

7865 |

|

|

|

|

|

|

|

|

‘cess |

| 11:06:51PM |

JAPAN |

19083 |

|

|

|

|

|

|

|

|

|

30/03/2020 FTSE Closed at 5763 points. Change of 4.59%. Total value traded through LSE was: £ 5,821,744,739 a change of -29.22%

27/03/2020 FTSE Closed at 5510 points. Change of -5.25%. Total value traded through LSE was: £ 8,225,273,197 a change of 4.62%

26/03/2020 FTSE Closed at 5815 points. Change of 2.23%. Total value traded through LSE was: £ 7,862,267,552 a change of -16.24%

25/03/2020 FTSE Closed at 5688 points. Change of 4.44%. Total value traded through LSE was: £ 9,386,988,784 a change of 9.28%

24/03/2020 FTSE Closed at 5446 points. Change of 9.07%. Total value traded through LSE was: £ 8,589,991,645 a change of -7.97%

23/03/2020 FTSE Closed at 4993 points. Change of -3.8%. Total value traded through LSE was: £ 9,333,810,024 a change of -32.33%

20/03/2020 FTSE Closed at 5190 points. Change of 0.76%. Total value traded through LSE was: £ 13,793,008,167 a change of 30.09%