#Brent #DAX When the US President, Mr Trump, recently moaned about the poor quality of modern toilet flushes, there was a definite “hold on a minute” in-house as we’d made an identical comment, one alas ignored by the worlds media. It was June last year (link) and an article about Kingfisher (aka B&Q), along with the reasons their share price was going to flush itself down to 184p.

We were correct about modern toilets and their illusory water savings and oh, yes, we were also correct about 184p as a rebound level.

Importantly, our 184p drop ambition was not breached, this giving the hope the current (somewhat moderate) rebound shall prove to have some integrity. The immediate situation suggests above 230p should now aim for an initial 240p with secondary, if bettered, calculating at a longer term 267p. Visually, it appears any rise risks foundering at the 267p as there’s little doubt a glass ceiling awaits at such a level.

That’s about the end of any positive spin on this story as we’re nervous at the slavish attention being paid to the downtrend since 2018. It has created the situation, where weakness now below the trend (208 presently) signals the prospect of reversal to an initial 197p with secondary, when broken, down at 175p. The secondary level scares us more than a modern WC as it takes the price into a region with 141p as “bottom”.

|

Time Issued |

Market |

Price At Issue |

Short Entry |

Fast Exit |

Slow Exit |

Stop |

Long Entry |

Fast Exit |

Slow Exit |

Stop |

Prior |

|

7:52:28PM |

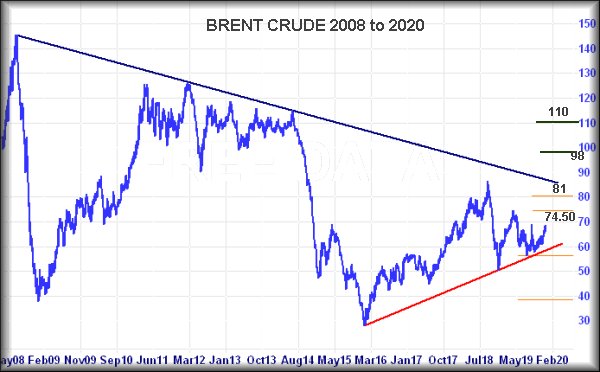

BRENT |

64.77 |

64.51 |

64.08 |

63.13 |

65.76 |

65.76 |

66.145 |

66.75 |

64.57 | |

|

7:54:52PM |

GOLD |

1562.49 | |||||||||

|

8:08:11PM |

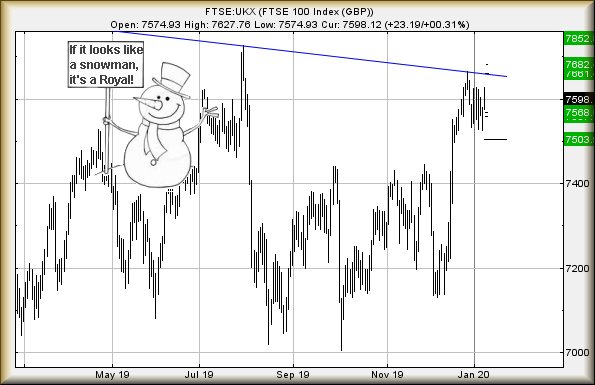

FTSE |

7570.69 |

Shambles | ||||||||

|

8:29:00PM |

FRANCE |

6017 | |||||||||

|

9:48:39PM |

GERMANY |

13447.65 |

13430 |

13413 |

13379 |

13519 |

13555 |

13628 |

13688 |

13433 | |

|

10:20:41PM |

US500 |

3263.42 |

Shambles | ||||||||

|

10:23:09PM |

DOW |

28806 |

‘cess | ||||||||

|

10:35:22PM |

NASDAQ |

8962.12 |

‘cess | ||||||||

|

10:37:34PM |

JAPAN |

23684 |

‘cess |