#DAX #FTSE #SP500 #GOLD This is always a difficult article to write, the last one of the year. With pundits everywhere warning of a major market correction in the first part of 2020 for ‘reasons’, we’re more inclined to look at the potential of domestic problems intruding. Oddly, it’s not Brexit but instead something called ‘The Declaration of Arbroath’, Scotland’s Magna Carta!

This document, penned 700 years ago, doubtless will feature during 2020 with the Scottish Govt once again stirring the pot for independence.

Despite archaic wording, it remains a powerful historical note, credited as the inspiration for the American Declaration of Independence. Words like “as long as but a hundred of us remain alive, never will we on any conditions be brought under English rule” give a clue to the tone of the parchment. Doubtless, this type of thing inspired the 6th verse, largely unsung, of the English National Anthem, ‘God Save the Queen’ with its slightly contentious lyric; “rebellious Scots to crush.“

This sort of nonsense, resonating through history, gives an excuse to turn up the volume in the Indie Debate, especially once Brexit happens. After all, everyone likes an excuse for a 700 year knees-up

In plain language, it looks like Scotland shall once again rock the boat, regardless of world markets.

A “Print This Out” section.

To signal potential danger levels against indices, on the S&P we think 3280 may prove troubling. If exceeded, 3500 almost must provide “issues”. The index requires below 2930 to spoil this calculation.

For the DOW JONES, travel to 29,900 shall not surprise us. And if bettered, 31,900 looks like a great level to try out a parachute. It will need below 27,000 to justify changing underwear.

Germany and The DAX is interesting as 14,100 calculates as possible. If bettered, it could even climb a 1,000 points higher before it “must” reverse. Below 12,470 and we’d start be concerned things are going wrong.

France with the CAC40 should run out of steam around 6,500 points. Needs below 5380 for panic.

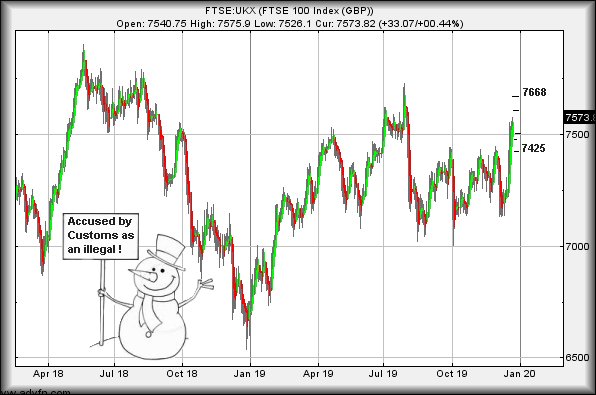

Finally, the FTSE. It feels like 7860 should provoke some sort of ceiling but if exceeded, the index could clamber up to 8050, a point where oxygen masks risk failing. The UK market requires below 6,750 to give serious concern for its future.

Our best wishes for a profitable 2020. And thanks for tolerating this (usually) unedited headline section, where we try and use words to glue the numbers together!

One of the civilised things in Scotland is the 2nd January being a holiday, so we shall return on Sunday evening.

|

Time Issued |

Market |

Price At Issue |

Short Entry |

Fast Exit |

Slow Exit |

Stop |

Long Entry |

Fast Exit |

Slow Exit |

Stop |

Prior |

|

10:00:51PM |

BRENT |

66.64 |

66.36 |

65.91 |

66.82 |

67.55 |

68.0775 |

65.54 |

Success | ||

|

10:06:00PM |

GOLD |

1515.87 |

1510 |

1505.5 |

1515 |

1516 |

1518.5 |

1497 | |||

|

10:07:49PM |

FTSE |

7575 |

7570 |

7561 |

7612 |

7640 |

7657.5 |

7586 |

Success | ||

|

10:11:15PM |

FRANCE |

5978 |

5974 |

5959.5 |

6027 |

6036 |

6053.5 |

5994 |

Success | ||

|

10:14:01PM |

GERMANY |

13126 |

13107 |

13081 |

13195 |

13259 |

13283.75 |

13190 |

Success | ||

|

10:15:52PM |

US500 |

3222 |

3218 |

3213.5 |

3230 |

3245 |

3255.5 |

3230 |

Success | ||

|

10:17:43PM |

DOW |

28465 |

28410 |

28377.5 |

28575 |

28658 |

28682.75 |

28420 |

Success | ||

|

10:19:50PM |

NASDAQ |

8714.75 |

8686 |

8656.5 |

8736 |

8788 |

8825 |

8741 |

Success | ||

|

10:21:56PM |

JAPAN |

23434 |

23415 |

23401.5 |

23586 |

23716 |

23820 |

23633 |

Success |

30/12/2019 FTSE Closed at 7587 points. Change of -0.75%. Total value traded through LSE was: £ 3,213,676,764 a change of 10.55%

27/12/2019 FTSE Closed at 7644 points. Change of 0.28%. Total value traded through LSE was: £ 2,906,900,069 a change of -43.81%

23/12/2019 FTSE Closed at 7623 points. Change of 0.54%. Total value traded through LSE was: £ 5,173,556,993 a change of -55.23%

20/12/2019 FTSE Closed at 7582 points. Change of 0.12%. Total value traded through LSE was: £ 11,554,966,677 a change of -10.44%

19/12/2019 FTSE Closed at 7573 points. Change of -100%. Total value traded through LSE was: £ 12,902,220,870 a change of 0%

18/12/2019 FTSE Closed at 7540 points. Change of 0%. Total value traded through LSE was: £ 6,288,425,252 a change of 0%

23/12/2019 FTSE Closed at 7623 points. Change of 0.54%. Total value traded through LSE was: £ 5,173,556,993 a change of -55.23%

20/12/2019 FTSE Closed at 7582 points. Change of 0.12%. Total value traded through LSE was: £ 11,554,966,677 a change of -10.44%

19/12/2019 FTSE Closed at 7573 points. Change of -100%. Total value traded through LSE was: £ 12,902,220,870 a change of 0%

18/12/2019 FTSE Closed at 7540 points. Change of 0%. Total value traded through LSE was: £ 6,288,425,252 a change of 0%

19/12/2019 FTSE Closed at 7573 points. Change of -100%. Total value traded through LSE was: £ 12,902,220,870 a change of 0%

18/12/2019 FTSE Closed at 7540 points. Change of 0%. Total value traded through LSE was: £ 6,288,425,252 a change of 0%