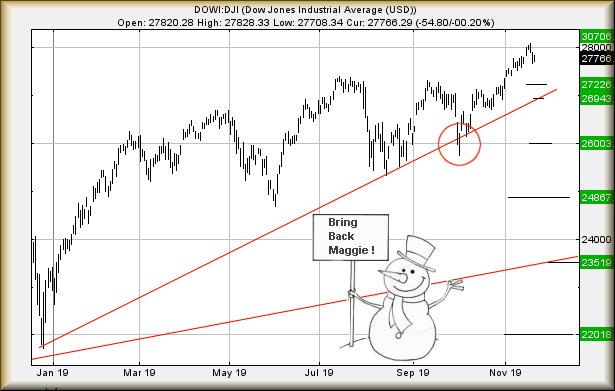

#FTSE #GOLD As the US rendered homage to turkeys while the UK PM paid homage to a chicken, markets experienced a pretty muted day. However, the Dow Jones remains optimistic and closed before Thanksgiving in useful territory for the near future. Hopefully the rally potentials continue.

For the DOW, now above 28,175 calculates with the potential of an initial 28,315 points. If exceeded, our secondary calculation comes out with 28,430 points. But realistically, this need not be the end of the story thanks to 29,125 points now lazing around in the clouds and claiming it’s a longer term attraction.

All kidding aside, in the event 29,125 ever makes an appearance, there’s a pretty good argument favouring a short position as we’d not be shocked to witness a 1,000 point tumble, once sufficient excuse had been invented to panic the markets. While we’re being cynical, somehow or other this sort of thing actually does happen.

As for the FTSE for FRIDAY, despite the index experiencing a lacklustre Thursday (we suspect, due to the US being closed), the FTSE certainly looks capable of some continued growth. We’ve a couple of small alarm bells ringing thanks to the market showing considerable hesitation exceeding 7,450 points but at present, the near term numbers come out as; Movement above 7,420 calculates with an initial useless ambition of 7,436 points. If exceeded, our secondary is at 7,466.

This scenario shall better the 7,450 level and create a new high (since August) on a Friday, generally not the most suitable day for exuberant behaviour.

If trouble is planned, reversal below 7,385 looks capable of an initial 7,350 points. If broken on any initial surge downward, our longer term secondary is at 7,323 points and hopefully a rebound.

Have a good weekend. It’s the final F1 of the season, probably a boring race as everything is already decided!

|

Time Issued |

Market |

Price At Issue |

Short Entry |

Fast Exit |

Slow Exit |

Stop |

Long Entry |

Fast Exit |

Slow Exit |

Stop |

Prior |

|

10:49:32PM |

BRENT |

63.32 |

62.52 |

62.35 |

63.37 |

63.55 | |||||

|

10:51:33PM |

GOLD |

1456.3 |

1452 |

1444.5 |

1459 |

1461 | |||||

|

10:57:17PM |

FTSE |

7412.31 |

7383 |

7371 |

7420 |

7432 |

Success | ||||

|

10:59:08PM |

FRANCE |

5915.7 |

5898 |

5887 |

5919 |

5925 |

Success | ||||

|

11:00:54PM |

GERMANY |

13255.36 |

13213 |

13201 |

13268 |

13282.5 | |||||

|

11:02:37PM |

US500 |

3151.32 |

3141 |

3137 |

3152 |

3154.5 | |||||

|

11:04:33PM |

DOW |

28118.7 |

28067 |

28020 |

28142 |

28174 | |||||

|

11:13:18PM |

NASDAQ |

8442.87 |

8409 |

8397 |

8444 |

8455.5 | |||||

|

11:14:54PM |

JAPAN |

23468 |

23375 |

23317.5 |

23485 |

23525 |