#Nasdaq #France The big question; was Boris creeping around Saudi oilfields last weekend with a box of matches? A Monday without a Boris/Brexit panic was almost enjoyable as the heat was taken off the UK’s much admired leader for a couple of hours. It didn’t last, and oddly neither has the Saudi panic. Without doubt, BJ has provided more entertainment in a few weeks than Theresa May did during her entire tenure.

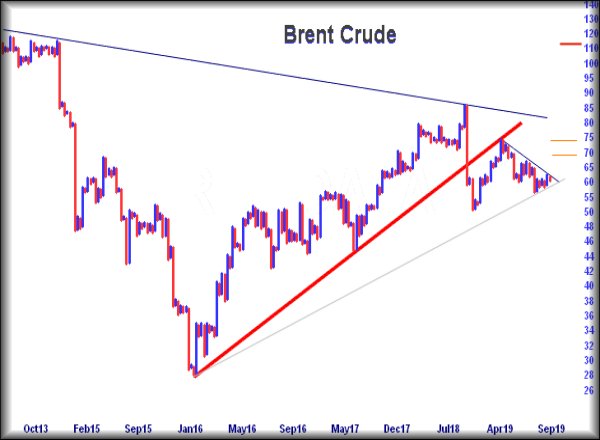

The Crude Oil price explosion hasn’t really happened. There was an absurd spike up to the 70’s when the Futures markets opened last Sunday night but as sanity prevailed in the light of day, nothing has happened (so far) to either justify nor sustain the upward surge. In fact, quite the opposite may prove true. At present, it’s trading around the 64 dollar mark and need only drip below 62.6 to give concern. A move such as this looks capable of triggering weakness to 60.39 initially. Worse, if our secondary calculates at 57.6 dollars and returns the price to the level it’s being languishing through July & August. This will also challenge the uptrend for 2019!

For any near term bounce of Brent to become interesting, allegedly above 64.50 should bring an initial 66.10 dollars. In itself, a pretty tame and useless movement but one we’d use to measure strength of sentiment. In the event 66.1 is exceeded, we’d expect a surge to 69 dollars next which will suggest some strength. Realistically, it needs above the previous high of 70.6 dollars before we’d dare feel we’re witnessed anything other than the panic reaction by a jittery market.

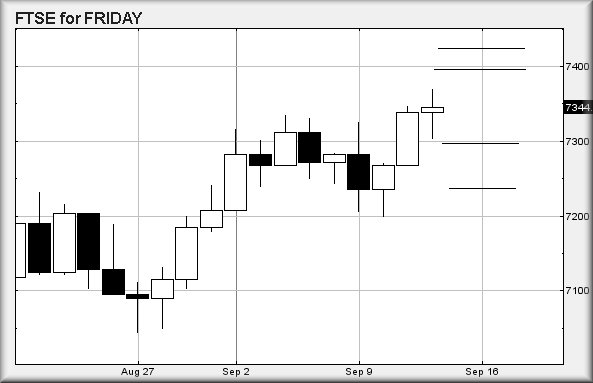

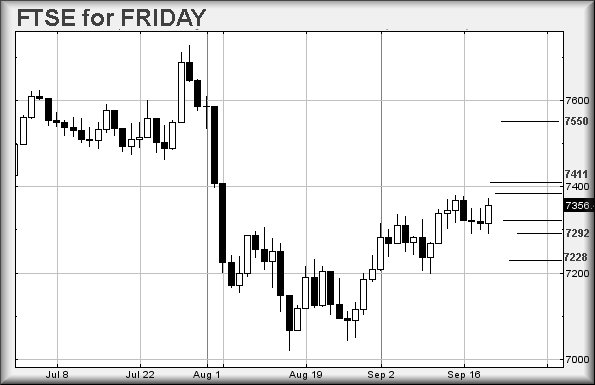

FTSE for FRIDAY The last 4 days managed to lack any real excitement. In fact, this week opened at 7367 points and closed Thursday at 7356 points, an 11 point difference. It’s not even worth pointing to what occurred in between as the 80 point range has been wholly artificial, created when the FTSE was marked down at the open on 2 days. The immediate situation tends mirror reality as movement now above 7373 should bring a surge to an utterly amazing 7384 points. If bettered, secondary is at 7411 points. The tightest stop in such a scenario is at 7336 points.

It can be assumed we’re not terribly impressed with the immediate potentials. To get real, the UK index needs above 7444 points as a further 100 point ride is expected.

In the event of weakness below 7336, we’re look at reversal to an initial 7325 points. If broken, secondary calculates as a more useful 7292 points. Should the UK manage below such a level, it could easily fall sharply to 7228 before any form of real bounce is expected.

|

Time Issued |

Market |

Price At Issue |

Short Entry |

Fast Exit |

Slow Exit |

Stop |

Long Entry |

Fast Exit |

Slow Exit |

Stop |

Prior |

|

10:12:07PM |

BRENT |

64.02 |

‘cess | ||||||||

|

10:13:54PM |

GOLD |

1499.49 |

‘cess | ||||||||

|

10:19:56PM |

FTSE |

7322.25 |

‘cess | ||||||||

|

10:22:26PM |

FRANCE |

5647.7 |

5641 |

5631.175 |

5610.7 |

5654 |

5667 |

5675 |

5685 |

5636 |

Success |

|

10:24:45PM |

GERMANY |

12425.68 |

‘cess | ||||||||

|

10:31:51PM |

US500 |

3005.17 |

‘cess | ||||||||

|

10:34:58PM |

DOW |

27079 |

‘cess | ||||||||

|

10:38:28PM |

NASDAQ |

7896.37 |

7828 |

7808.5 |

7761 |

7917 |

7934 |

7959 |

8016 |

7856 |

‘cess |

|

10:46:47PM |

JAPAN |

22094 |

Success |