#GOLD #SP500 We constantly remind readers we’re not gifted with time travel. When “the computer” makes a price projection, the stupid box is completely unable to pull a Dr Who stunt and give a timeframe. It’s a bit like predicting a Brexit date – not possible other than knowing it will happen. Probably! As a result, the safest thing we can suggest is not getting excited about a share being “cheap” if a ruling sector trend suggests downward travel.

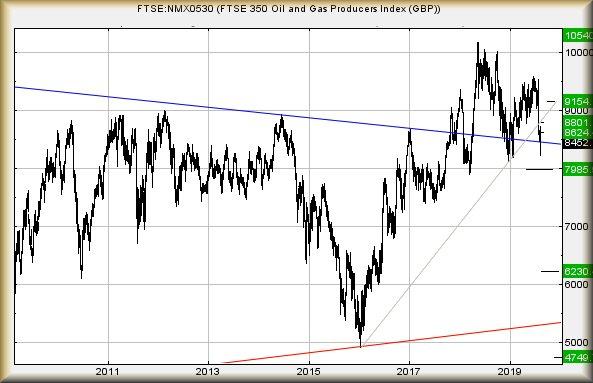

The Oil Sector is presently in a slightly scary place with some truly foul potentials. As a result, Oil Shares doubtless face a bumpy ride if the sector wanders below 8,214 points. We’d regard this as the trigger for reversal to a harmless looking 7,985 and hopefully some sort of bounce. Alas, we’d suspect any bounce shall prove short lived – especially if the initial surge down breaks our 7,985 target level.

The implication of a break will signal the risk of continued weakness down to 6,230 points, perhaps even a bottom at 4,749 as the “ultimate” point at which a proper rebound can be hoped. This, unfortunately, even makes some visual sense.

We’re not optimistic about the sectors chances but near term, there is potentially the opportunity to map sector strength. Above 8485 points calculates with an initial potential of 8624 with secondary, if exceeded, coming along at 8801 points. This will at least challenge the most recent uptrend and allow a longer term 9,154 points along with confirmation the entire sector is “rangebound” for the present.

|

Time Issued |

Market |

Price At Issue |

Short Entry |

Fast Exit |

Slow Exit |

Stop |

Long Entry |

Fast Exit |

Slow Exit |

Stop |

Prior |

|

10:01:01PM |

BRENT |

59.47 |

‘cess | ||||||||

|

10:02:49PM |

GOLD |

1496.67 |

‘cess | ||||||||

|

10:04:25PM |

FTSE |

7180.29 |

Success | ||||||||

|

10:06:31PM |

FRANCE |

5358.2 |

Success | ||||||||

|

10:09:10PM |

GERMANY |

11700.33 |

‘cess | ||||||||

|

10:11:59PM |

US500 |

2921.72 |

2899 |

2886 |

2867 |

2927 |

2932 |

2936 |

2949 |

2909 |

Success |

|

10:14:34PM |

DOW |

26124 |

Success | ||||||||

|

10:16:46PM |

NASDAQ |

7712.62 |

Success | ||||||||

|

10:18:42PM |

JAPAN |

20645 |