SAGA PLC (LSE:SAGA) Our previous review against SAGA had a pretty grim drop target, especially as it was trading around 120 at the time of report. Time, the mortal enemy took hold, Saga indeed withered to our 67p this year. Which is a bit funny, given Saga’s mission is to exploit folk battling the ravages of time.

It’s always easy to treat the old and decrepit, those above 50, with some distain. But our software, developed entirely in-house, was created by someone who’s been dying his hair for 30 years already! In fairness, a family trait ensured he cultivated a badgers white streak from his 20’s.

The scary thing about our 67 “bottom” was not the calculation but rather, the method employed by the market to take the price down. On April 4th, the price of SAGA was manipulated (gapped) from 107p directly to 67p. This was a disaster, the harsh movement tending imply the market wanted the share price below our target level. As time hacked away at the share, it was to eventually reach 31p, a price level we simply cannot understand. When we look at it, about the only thing it represents is one of these moments when you go into a room and immediately forget why you’re there. We cannot emphasise sufficiently, we’ve no idea why 31p appeared. Anything below 67p took the price into a region where we could calculate no lower.

For now, it’s probable the best thing we should do is look for signals SAGA share price is recovering with some integrity. Moves now above 50.1p are supposed to generate recovery to an initial 56.75p. If exceeded, the very first box is ticked to suggest bottom is “in”. Secondary, if bettered, calculates at a longer term 86.75p and takes the price into the region of the April Gap (circled). Generally this can be regarded as a good thing, giving considerable hope for the future.

|

Time Issued |

Market |

Price At Issue |

Short Entry |

Fast Exit |

Slow Exit |

Stop |

Long Entry |

Fast Exit |

Slow Exit |

Stop |

Prior |

|

9:41:09PM |

BRENT |

63.17 | |||||||||

|

10:06:12PM |

GOLD |

1425.48 |

1419 |

1411.785 |

1398.09 |

1431 |

1431 |

1437 |

1450.11 |

1422 | |

|

10:08:12PM |

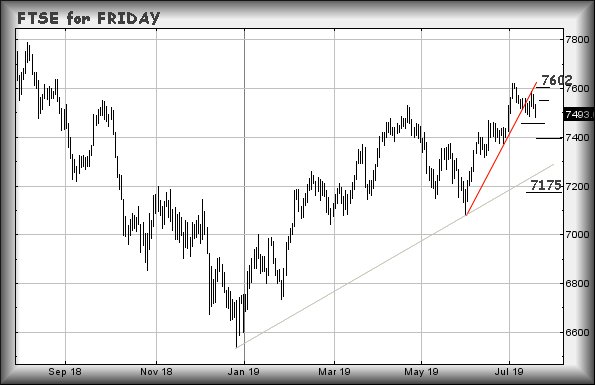

FTSE |

7522.29 |

‘cess | ||||||||

|

10:09:37PM |

FRANCE |

5567.2 | |||||||||

|

10:15:38PM |

GERMANY |

12314 | |||||||||

|

10:17:19PM |

US500 |

2987.72 |

2968 |

2949 |

2924 |

2988 |

2991 |

2995 |

3003 |

2975 | |

|

10:19:13PM |

DOW |

27187 | |||||||||

|

10:21:02PM |

NASDAQ |

7912.99 | |||||||||

|

10:22:45PM |

JAPAN |

21416 |